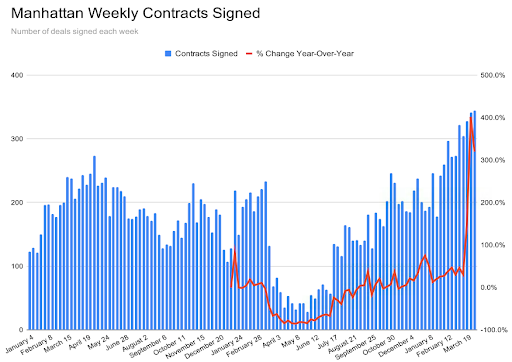

That was some first quarter. Closings were up 66% from the lows of the Q3 2020 and it was the busiest March in 14 years. Favorable metrics (low interest rates, low prices and high inventory) and an overwhelming improved sentiment have been the driving factors of Manhattan’s return. New Yorkers have always been believers, dreamers and doers…and this city is being willed back, it’s a Renaissance which will define a new New York. It will be different; it will be better. With renewed certainty provided by vaccines and improved sentiment, increasing numbers of people are grabbing their seats (homes) in this game of musical chairs. They realize that today’s opportunity will not be here for long.

Courtesy UrbanDigs

The explosion of deal volume in the first quarter will continue to methodically raise prices. What will counter balance any spike will be increasing interest rates, restricting what buyers are actually able to offer. So if you’re a buyer, harnessing your strong purchasing power today, coupled with fair pricing, spells opportunity…a dynamic which will have vanished in the coming years. Predictably, fear of missing out will intensify as more neighborhoods turn in the seller’s favor; it will only be then that buyers will realize the opportunities that existed now. Prices will not spike, but again purchasing power, coupled with leaner inventory and increasing competition will make it more and more difficult to secure the value that exists now. And oh…did I mention competition? Wait until everyone wants to get back in; it will be like trying to secure a vaccine appointment now that virtually everyone is eligible.

If you fear you’ve already missed out, that is far from true. Although some neighborhoods like the Upper West Side are now leaning in the seller’s favor, the majority of Manhattan is still in a buyer’s market. Yes, as we discussed last month, inventory is drying up (from 9,500 to 7,000), interest rates are rising (1/2 point with some lending institutions in just 7-8 weeks) and prices have begun to reflect that demand; however, consider where the market will be several years from now. You may have missed the absolute bottom, which was several months ago, but you will still be buying in “the bottom”. Those who purchase in 2021 will likely feel they purchased at the best time.

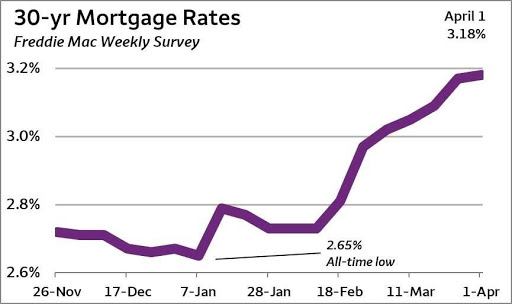

Prices will not spike, but they are moving in a different direction and favor the seller. However, it’s not prices that will be the killer for the buyer, it is interest rates…and they are rising. See recent movement in the chart below.

Interest rate hikes are no joke. Check this out….

$1M borrowed @2.75% = $4,082/month

$1M borrowed @3.25% = $4,352/month

That .5% increase in your rate costs you an extra $270/month; that’s $3,240/year extra for the same loan.

In other words:

Where $4,082 would have afforded you $1M 6-7 weeks ago; today you could only borrow $938K. That is a 3.8% erosion of your purchasing power in just 6-7 weeks.

Note: rates are fluctuating daily, so this is simply a snapshot to demonstrate the importance of rate moves.

Sellers must also pay attention to this, as a sustained increase in rates will put mounting downward pressure on their prospective buyers’ purchasing power. Imagine if rates go up to 4.65%? I choose this arbitrary number, because this is where rates were not but 2 ½ years ago in the Fall of 2018. That would be 20% less purchasing power.

Also note: although rates have come off of their lows (of approx. 2.65%)…in relative terms, rates are still very low. See the historical chart below for perspective.

The explosion of deal volume in the first quarter will continue to methodically raise prices. What will counter balance any spike will be increasing interest rates, restricting what buyers are actually able to offer. So if you’re a buyer, harnessing your strong purchasing power today, coupled with fair pricing, spells opportunity…a dynamic which will have vanished in the coming years. Predictably, fear of missing out will intensify as more neighborhoods turn in the seller’s favor; it will only be then that buyers will realize the opportunities that existed now. Prices will not spike, but again purchasing power, coupled with leaner inventory and increasing competition will make it more and more difficult to secure the value that exists now. And oh…did I mention competition? Wait until everyone wants to get back in; it will be like trying to secure a vaccine appointment now that virtually everyone is eligible.

Issues still TBD: NYC taxes, fiscal policy out of Albany, the Mayor’s race, the city council seats…

Please join me on Thursday’s at 4pm EST as I co-host a weekly zoom program called “Boroughs & Burbs” with my colleague John Engel. We talk about innumerable real estate issues and topics in New York and its suburbs which include CT, The Hamptons, NJ…we’ve recently even tapped into to see what’s been going on in Palm Beach, Miami and L.A.

Thursday’s from 4-5pm Click here to join us

Roberto Cabrera

Roberto Cabrera

Licensed Real Estate Broker

Brown Harris Stevens

212.906.0554

Your City, Your Broker…

#YourCityYourBroker #NewYork #Manhattan