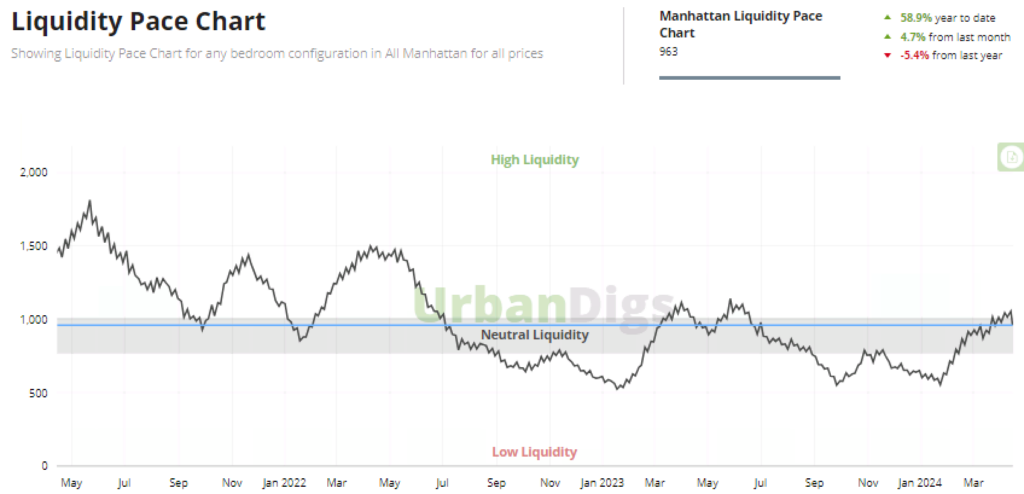

Although the market has picked up in many respects, meaning increased showings and offers, which comes with the Spring season, it’s actually shaping up to be a bit of a bore…and buyers should be loving this. The reason for my statement is that expectations for an explosive Spring have been dashed and the primary culprit, still, is interest rates. In December, the Fed had indicated some five rate cuts to start in March, which…weeks later…turned into three or four cuts not starting until June, then two cuts not starting until September to even perhaps no cuts. These decisions have been driven by sticky inflation which remains at higher levels than the Fed’s goal. The strong economy, evidenced by a very strong jobs report, has disincentivized the Fed from lowering rates, as they fear a worst-case scenario of another spike in inflation. Consequently, we’re back temporarily to “higher [rates] for longer”. Likewise, the result disincentivizes sellers from listing and makes buyers more cautious about committing.

Charts Courtesy: UrbanDigs

This scenario actually plays well for buyers. I was with a dear, and very experienced, colleague the other night at a dinner, who when speaking on the market said, “yeah, this is the darndest (paraphrasing) market, but as all of us who’ve been doing this as long as we have know, it’ll turn around.” She’s saying this as a comment on the mere moderate deal activity we’re experiencing at the moment, but there’s far deeper meaning packed in her statement for each party in the transaction. Whichever side you’re on now, your perceived circumstances may not actually be what you think (meaning you have to see the forest for the trees) and yet…those circumstances will change again. When they do, too often, it’s too late and people emerge with a “could’ve, should’ve, would’ve” excuse/predicament.

For sellers it requires pricing right and patience. There is a direct correlation between price and “days on the market”; the fewer the days, the more accurately you priced and got the deal done. As days mount, you realize that you overshot the mark and value begins to erode. Deals are difficult to put together these days; you have to be patient. The economics are unrecognizable from where they were in years past. Also, if your property needs work (which for buyers can be your greatest opportunity), you really need to price it right, as the costs of doing a renovation have risen substantially. Renovating was always expensive; but since Covid, when supply chains were disrupted and now inflation,…the math is simply different. As a seller you need to reconcile that delta and price right in order to find your buyer.

For Buyers, her statement’s meaning is in the counter-intuitive subtext. Being that it’s a “tough” market to maneuver, it presents opportunity. As many are still conflicted about making the commitment, others can get in and seize a great property. I am sure you are so sick of me saying this every single month, but after 26 years, to me this is the preeminent truth about our marketplace…the greatest barrier to entry into the Manhattan marketplace is not the price, it’s the competition. Note: if you think it’s expensive now…just wait until next Spring when the flood gates open and everyone, and all their relatives, will be scrambling to buy.

If you’re a buyer, embrace the boredom of the current marketplace.

I always say: 1) Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them; and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.

I always say: 1) Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them; and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.