By Carol Tannenhauser

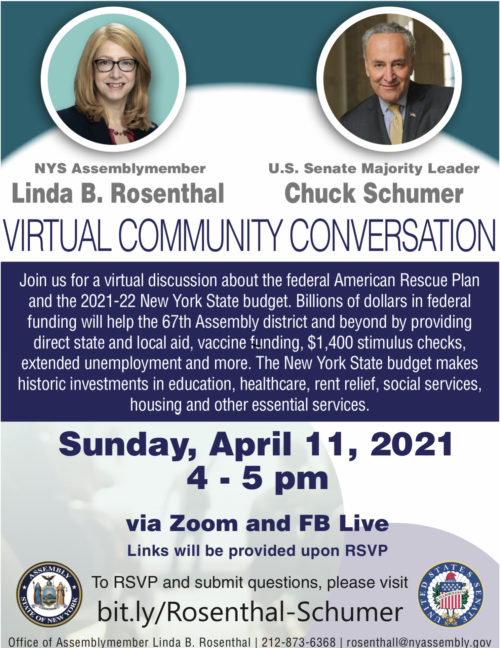

On Sunday, April 11, from 4 to 5 p.m., U.S. Senate Majority Leader Chuck Schumer will join New York State Assemblymember Linda Rosenthal for a virtual conversation with the community about the federal American Rescue Plan and the 2021-22 New York State budget.

“Billions of dollars in federal funding will help the 67th Assembly district and beyond by providing direct state and local aid, vaccine funding, $1,400 stimulus checks, extended unemployment and more,” Rosenthal said, in a press release. “The New York State budget makes historic investments in education, healthcare, rent relief, social services, housing and other essential services.”

Schumer and Rosenthal will be taking questions, either submitted in advance via the registration link, or at the event via Zoom. The conversation will stream live on Facebook and Instagram.

Here again is the link to RSVP and submit questions.

I will be unavailable for this. Please someone ask why tax payers have to fund illegal immigration slush fund? 2.1 Billion of your hard earned dollars. Also Chuck keeps saying there are only 11-12 million in our country but MIT has a current study that has the figure around 22-25 Million in our country.

You mean that MIT study from three years ago or this one (https://mitsloan.mit.edu/ideas-made-to-matter/why-restrictive-immigration-may-be-bad-u-s-entrepreneurship [“Why restrictive immigration may be bad for U.S. entrepreneurship”]) from last year?

They seem to have left out the part that raises our taxes in New York State and City to the highest levels in the country. Perhaps this was just an oversight ?

You mean the part of the NYS budget that

• Increases the current top state personal income tax rate of 8.82% to 9.65% for individual filers whose income is over $1M and joint filers over $2M.

• Establishes two new brackets at a rate of 10.30% for those whose income is between $5M and $25M and 10.90% for those whose income is over $25M.

• Increases the Corporate Franchise Tax Rate from 6.5% to 7.25% for three years, while leaving the rate of 6.5% unchanged for companies with under $5M in income.

…OR the part that

• Delivers $440 million in property tax relief for 1.3M New Yorkers earning under $250,000 based on the proportion of their income spent paying property taxes. The income tax credits will range between $250 and $350.

• Ensures that $400M in middle-class personal income tax cuts are not delayed.

(https://www.nysenate.gov/newsroom/articles/2021/alessandra-biaggi/2021-2022-new-york-state-budget-breakdown)?

Sorry this will adversely affect you; I myself fall squarely in the 2nd category.

Thanks, jms. Great comments.