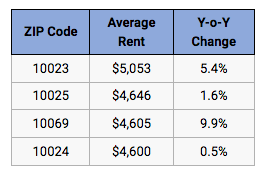

Bad news, renters. The Upper West Side has only gotten more expensive in the past year. New data from RENTCafe shows that all four zip codes in the neighborhood have seen increases, ranging from 0.5% to 9.9%.

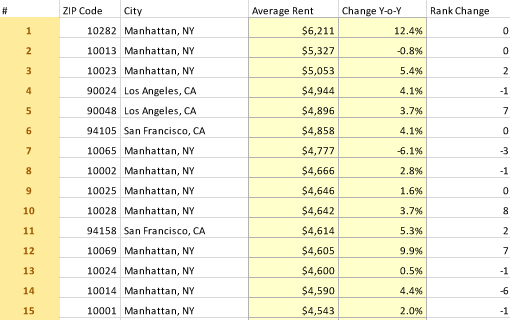

RENTCafe also did a nationwide survey, looking for the zip codes with the priciest rents, and found that the Upper West Side accounts for a disproportionate number of them. Yes, even more than L.A. and San Francisco. The only spots in the city with higher rents, on average, are downtown zip codes 10282 and 10013.

The rents are averages, measuring all apartment sizes. RENTCafe looked at 17 million apartments across the country.

One recent theory about why rents continue to rise is that all the luxury condos now being built are too expensive even for most wealthy people. So those wealthy people are renting, and are thus pushing up prices for rentals. ”

I’m not surprised about LA (it’s cheap/easy to live there) but am quite shocked about SF

San Francisco’s housing situation is far worse than NYC.

Very strict local zoning coupled with strong anti-development means the city doesn’t have remotely enough housing units. Pile on Big Tech has made SF a major headquarters and you have a housing market fueled by large numbers of well off to very wealthy all seeking housing in same area.

Despite being voted down as a ballot initiative, California lawmakers recently enacted state wide rent control.

https://www.nytimes.com/2019/09/11/business/economy/california-rent-control.html

As with NYC many local California areas created their own housing mess. Various laws, rules, regulations and so forth restrict development. Thus number of housing units falls far short of what is currently necessary. Short supply + high demand =’s high prices.

But you gotta have a car… more expense

Part of the reason rents go up because real estate taxes on buildings go up astronomically every year. I own a small building and I can’t recoup the RE tax increase every year. The building barely breaks even to begin with so increasing taxes force up rents.

The other problem is the UWS is so landmarked that very little new construction especially reasonable price rental buildings are ever built. I’m all for preserving notable architecture but not every crappy building on the UWS needs to be preserved. Preserve the good ones and let “some” of the others be redeveloped and bring new housing options to the UWS.

Permanently taking a million apartments out of the market = no supply = rents rising. Act shocked.

Not very useful stat when you don’t know the distribution of apt size. They should do by bedrooms and or square foot.

Totally agree. These numbers are useless without context.

Agreed…I tend to think of 10023 as a spot with lots of new rentals…many of which are quite large…I’m not in 10024 anymore, but my sense is that most of the rentals are old/older housing stock. The 10024 rental boom was late 90s early 00’s

Sounds like Ariel 6br penthouses are skewing the figures. These are not rents you typically see in pre-war buildings.

Is it possible that this is reflecting all the new luxury supply coming onto the market? Not just owned units being rented but new rental buildings.

I tend to agree with you.

If a bunch of expensive and upscale rental buildings recently entered the market this could have skewed the average rental data. This does not necessarily mean that everyone’s rent has gone up.

Perhaps a more meaningful survey would be the rent expense in buildings that have been open for at least two years.

There are many ways that “ studies” can play around with data.

Yes Sherman, about your comment, “There are many ways that “ studies” can play around with data.”

The expression is “Figures don’t lie; but liars figure.”

Where does RentCafe get the data? Leases are not registered, at least not in NYC. So is this listing price? Before concessions like 13th month free? It also is only buildings with 50+ units. That surely skews the results especially for UWS. You are basically looking at only doorman buildings for example. Which have a say $500 premium.

Manhattan Rental Market Report (MNS) for August 2019:

https://www.mns.com/manhattan_rental_market_report#report_explained

Elliman Report for 3rd Quarter: https://www.elliman.com/pdf/51d265ba20ca567f27667d093f0471efaf32f641

Amen. The so-called rent data for most apartments is based on listings, not leases. We moved to our UWS apartment in 2010 and have yet to pay the rent shown on StreetEasy.

Agreed. Absolutely not accurate when most buildings on UWS are not more than 50units. So definitely reflects the expensive new builds on the market.

Median rent would have been a better statistic than average

Whereas almost everybody pays the Mean rent.

I’ve been looking and rents over here are ridiculous. Its worse to purchase than to rent. Most of this stuff is just not worth the asking price. You find much better deals on the Upper East Side, both to rent and to buy (at least 10% less). And now you have 2 subway lines, Fairway, Whole Foods, etc, up there.

Its an absolute crime… should not be tolerated. Rapacious rates.

Market rate rents are increasing all over Manhattan, Brooklyn and a few other areas. For various reasons condo sales have tanked (at all segments of market), and those who would have bought are cooling their heels by renting instead.

Market rate rentals are a minority of NYC housing market. Thus it stands to reason rents are rising in desirable areas. It is economics 101, high demand versus small supply equals higher prices.

There hasn’t been that much new rental construction on UWS (or city for that matter). Much of what has gone up recently is condos.