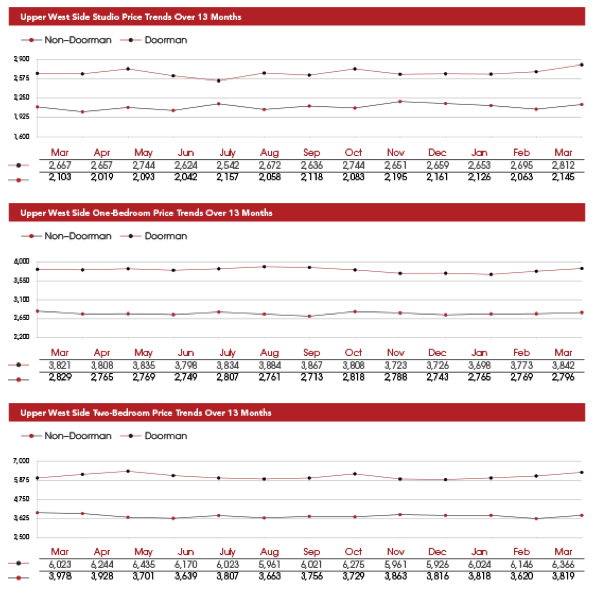

After a few months of treading water, Upper West Side rents have resumed their interminable climb, with March rents rising by an average of 3.4% over February, according to MNS. All types of apartments saw a month-over-month increase, although that may have to do with rising demand during the spring season (ultra-luxury apartments are omitted so as not to skew the averages too much). On a year-over-year basis, rent increases are still relatively subdued compared to previous years.

March 2015

- Studio (with doorman) $2,812

- Studio (no doorman) $2,145

- One-bedroom (with doorman) $3,842

- One-bedroom (no doorman) $2,796

- Two-bedroom (with doorman) $6,366

- Two bedroom (no doorman) $3,819

The chart below shows average rents for each type of apartment on a monthly basis from last March to this March. Click to enlarge the image (the top section is for studios, the second section is one-bedrooms, and the bottom is two-bedrooms).

I recently received my lease renewal for my UWS studio, and it had a 9% increase. I negotiated it down to a 7% increase. That still wipes out most of my after-tax raise from work last year, which I worked very hard for.

What else is new!

Life is a beach.

wide disparity in 2 BR prices must reflect doorman building is new or large prewar, versus the non-doorman in a brownstone with probably minuscule rooms

I moved out of the UWS last Fall at my lease renewal because management companies they don’t have to follow rent increased approved by the city. I was paying $2,766 for a studio, and they were going to raise it 6%. I argued, and they said they were legally allowed to raise it to $10,400. Insane.

Hi Greg and 9d8b7988045e4953a882: That is most likely because your apt. is destabilized. If you make over a certain amount of money, and your rent is over $2500, then you are not protected by rent-stabilization laws. In that case you can always negotiate with the landlords to keep the increases down. Also, if you are in a building with less than 6 units, there is no rent-stabilization.

From the Rent Stabilization Board’s website, an apt. can be de-regulated when:

the apartment has a legal regulated rent of ($2,500) or more per month AND the apartment is occupied by persons whose total annual household income exceeds ($200,000) in each of the two preceding calendar years

(imho if one makes over $200,000 a year, you can afford these crazy rents!)

OR

2) A rent stabilized apartment which becomes vacant and could be offered at a legal regulated rent of ($2,500) or more per month is no longer subject to rent regulation.

in case of #2, it really pays to negotiate aggressively with the landlord. They don’t like to turnover apts if they have reliable tenants.

Thanks Wendy for the info. I am actually a market-rate renter, so that doesn’t apply to me.

NYC is turning into a gated community. Sad. How can people live here?

What are you talking about Judy? Have you not heard of the NYC housing authority?

Judy, these are averages for one part of one borough, the Upper West Side of Manhattan. Go farther uptown and the costs are more reasonable. Go to the Bronx and rent a huge apartment near a subway line for what a studio near Lincoln Center costs. Priced out of gentrified Brooklyn? Believe me, there is a lot of Brooklyn that isn’t gentrified, but is full of old-fashioned comfort. Want a whole house? Go to Woodside in Queens. Or

to whole reaches of the Bronx. I should be saying something about Staten Island, but all I know is the ferry and what is close to the terminal. I don’t own a car. I suspect it’s easier to live on Staten Island and the Bronx if you have a car.

I don’t like that you’re comparing living in NYC to living in a gated community. Market values are cruel, I agree, but there’s nothing gated about our hugely diversified neighborhoods. Living in NY has always involved a little imagination and a whole lot of patience.

I agree Martha but if things keep going as they are, the community Will Not be diverse and Will Become a gated community. Sad but true!

I invite my former (30 years) West Side neighbors to saunter , amble, jog, hike , ride , take a bus or short subway ride to my bucolic adopted neighborhood ( 8 + years) in the Bronx historic district . If what you see with your own eyes doesn’t convince you, check out the prices, give me a call and I’ll buy you a cup of coffee so you can pick my brain. I , TOO, LOVE NEW YORK

Left y beloved NYC UWS in 1998, was at 477 CPW 2 bdrom facing rear, on 108, rent was 990, revisted bout two yrs ago it was going for about renting almost @ 3.8K probably being sold 2.5+++.

Now in 3500ft Home in San Antonio – monthly 1300, walk to HS school very nice area taxes about 800 – I love my UWS and maybe we’ll relocate after retirement but that dream seems further away every month

It never hurts to try negotiating with your landlord. I gave my building’s management company a list of comps and offered to re-sign my lease with no increase. If you are a good tenant, the words of the old country song ring true here… “It’s cheaper to keep her.”

So much blame goes to landlords. The blame really rests on the city. Have any of you any idea of the huge increase n real estate and water and sewer taxes? And that families occupying an entire building, in other words the millionaires, pay lower real estate taxes that those needing to rent out to meet expenses? Doubt it. And that landlords need to raise rents on market rate apartments to offset the low rents on stabilized and controlled apartments. This is benefiting the entrenched and the rich but is destroying the city. If a business is controlled, encumbered and unprofitable, there will be no new entrants. High rent buildings are profitable. Welcome to Economics 101.

what contradicts this is that rent stabilized buildings are extremely profitable. the stats for every year are on the site of the Rent Guidelines Board.

when they then take the apts into market rate — they get “superprofits”. but the operating margins are quite high on rent stabilized apts.

Maybe it should be… if you can’t make it as a landlord. Get out of the profession. Don’t hand it down to the little guy who needs a roof over their heads. People chose to own real estate. It’s a luxury that not everyone can have. If taxes too high and such, get out of the business!

“If you can’t make it as a landlord. Get out of the profession.”

And if you can’t make it as a tenant, move. Works both ways, eh?

I thought these messages were edited to prevent rudeness such as yours. Apparently not. Be careful what you wish for You will regret it. Yes, that is exactly what is happening and all multifamily apartment buildings are being sold and turned into one family homes which are taxed at a lower rate. That should be your target if you must have one and you must. Expenditures will again be higher than income. the city will raise taxes again, on the middle class of course, \ and the few remaining small landlords which will be forced to sell. Who will put a low cost roof over your entitled head then? Think Chicago, think Detroit, or think N.Y. in the 70s.

Eliza, yes a single family should be taxed at a lower rate. Their occupancy of the building uses less school seats, garbage collection, road damage, less water, puts less into the sewers etc.

And I’m certainly not entitled.

Eliza… Sorry you think so. I’m not a rude person and I don’t think I’m being such. I’m just being realistic and stating the obvious.

And one- and two- bedrooms aren’t what they used to be, at least in my buildings: all 1BR have had an extra “room” carved out of a living room or kitchen to make a 2 BR. Illegal, of course, as there are no permits for these extra rooms. 2BRs have also had an added “room” built in. Students are crowding into these apartments, the noise levels are going up, elevators and laundry facilities are overused and break down often. Why won’t the city make landlords open their books?

While there are some small landlords who may have insufficient rental income and difficulty paying taxes, there are plenty examples of rents going up due to real estate speculation. For example as reported in West Side Rag (5/1/14) “Developer Adam Mermelstein at Treetop development just flipped 12 buildings located between West 105th and 115th streets for a 67% gain — and he had just purchased them two years ago.”

In addition, the international wealth that has gone to buy up NYC real estate (One57 perhaps the most famous example) profoundly impacts on housing costs for everyone else. Space is going to building for the very wealthy. Rental buildings in previously middle-income/low-income/affordable areas are being emptied to convert to luxury condos or torn down for constructon of new luxury buildings.

I ama fifth generation New Yorker. Am horrified by what has happened to NYC.

amen.