By Gus Saltonstall

We hear a lot about the scarcity of “affordable” housing and the excess of “luxury” housing on the Upper West Side, but what’s happening in the realm that most people inhabit: “middle-income” housing?

“Rents on the West Side of Manhattan are increasingly rising higher and higher. Tenants who are not under rent stabilization are not safe,” said Charlie Dulik, the director of a nonprofit dedicated to preserving housing and providing free legal services for tenants in Manhattan, in an interview with West Side Rag.

A drama unfolding at 600 Columbus Avenue, on the corner of West 89th Street, is one example of how prices can escalate swiftly in a rental building. The 166-unit building has housed middle-income residents since it was constructed in 1986. Now, longtime residents allege that new owners are using callous tactics to push them out of their apartments so the owners can make a bigger profit.

600 Columbus was purchased in February 2023 for $120 million by Slate Property Group, a New York City real estate developer and lending company. In the months following the sale, a resident who spoke to the Rag – but asked to not be identified for fear of retaliation by the landlord – said that the new ownership has orchestrated an “inhumane displacement process” that has set off an exodus of tenants from the building and caused panic among those who remain.

The building in question has no rent-stabilized units, but about 20% of the tenants receive Section 8 assistance, which helps low-and-moderate income New Yorkers rent market-rate apartments.

According to several of the market-rate tenants who spoke with the Rag, some residents have been told abruptly that their leases will not be renewed. Others were given an option to move out for some months while apartments are renovated, after which they might be allowed to return to the same apartments. And some have simply been offered lease renewals at significantly higher rents, according to tenants.

When the building sold in February 2023, listings showed the average one-bedroom apartment in the 14-story property rented for around $4,000 a month.

Now, residents told the Rag that the new asking rents to stay in apartments rose by as much as roughly 60 percent.

Apartments that had cost $5,000 a month, were now going to cost tenants closer to $8,200, according to multiple residents.

Other tenants confirmed to the Rag that their rents had gone from between $4,000 and $6,000 a month, to somewhere between $7,000 and $9,000 a month.

In some cases, the new asking rents have appeared to climb even higher. There are currently four listings for 600 Columbus Avenue on the platform LeaseBreak, which specializes in shorter and more flexible leases. Two listings offer studio apartments, one for $4,500 a month, another for $4,800. A two-bedroom unit is offered for $12,000; the same price is listed for a three-bedroom apartment.

“They’re subletting short-term leases to people who can afford to pay $10,000 a month for holidays, and it has made the building very transient, with people coming and going,” another longtime resident, who also requested anonymity, told the Rag.

A spokesman for Slate, the new owner, said the listings on LeaseBreak were made by another company that Slate leased those units to; that company specializes in temporary housing for corporate clients.

Asked about tenant allegations of big rent increases and tactics that appear aimed to push out some current residents, a spokesperson for Slate said in an email:

“The average change to market-rate leases has been 8.6% after a period of no increases at all. We believe this is the right path to keep this building safe, attractive, and welcoming, and the vast majority of residents are choosing to stay with us and call 600 Columbus home.”

Multiple residents confirmed to the Rag that there had been rent increases two years ago under previous owners, and none said they had received a rent increase of just 8.6 percent.

Tales from Tenants

One resident of 600 Columbus Avenue knows the commute perfectly from her longtime home in the building to her place of work in downtown Manhattan. That’s vital for the tenant because of her vision difficulties.

“I’m going through vision changes, so I can’t see at night, but it is easy for me since I know my route to work and getting home,” she told West Side Rag. “The thought of that changing is scary.”

The local is one of eight current and former residents of the Upper West Side building that the Rag has spoken to about the exodus at 600 Columbus Avenue. All of the residents spoke on the condition of anonymity, citing fears of a possible retribution from building management or other landlords who might review them as they look for new homes.

“I have so much anxiety about it,” said the same resident, whose lease isn’t up until the summer and does not know if her family will be offered the chance to stay. “I have a child going to high school next year, the building is all they know. The thought of looking for another apartment is terrible.”

Multiple tenants told the Rag that the new owners had thrown everyday living situations into uncertainty, especially for those residents with school-age children.

“I don’t even have the bandwidth to fight with them right now. I’m trying to keep a job in this economy. I’m trying to do right by my child and family,” said one resident with a school-age child. “They’re making our life hell. It’s a bunch of great people and families, single parents, and there is so much camaraderie and kindness between those of us that have been here for years.”

That resident has not yet been issued the official letter that their lease won’t be renewed, but they expect it in the coming months.

Several tenants described the stomach-sinking feeling of receiving notice that their leases would not be renewed.

“I know it isn’t an eviction, but it feels like an eviction,” said one. “It seems like they just want to clear out the building, rather than have tenants here.”

The thought of moving and the expenses that come with it is driving at least one resident to consider leaving the city after living on the Upper West Side for decades. Building management recently told the tenant they had three months to find a new home.

“The rent rates are so exorbitantly high that maybe New York City is not for me,” this tenant said. “I’m single, I have no kids, so I want to have money when I’m older, because who is going to take care of me?”

Residents also said that while they’ve been told their leases won’t be renewed, the owner has also informed them they can’t break their existing leases before they end.

“It’s contradictory,” said one. “You want us to move out and you’re going to push us out when the time comes, but if we find a good deal before that date, you won’t let us leave?”

Tenants Joining Together

At least 60 residents of 600 Columbus Avenue formed a group that has met with Dulik, the tenant’s rights housing expert, to understand the legalities of the situation and discuss possible strategies to fight back against some of the owner’s moves.

Dulik said that while those actions have been frustrating for tenants, the developer appeared to be acting within legal rights. “I can’t predict the future, but it is a really tough position to be in when the landlords have the upper hand legally,” he said. “I know a lot of the tenants are parents, have kids they take care of, they can’t deal with an extended court saga or instability.”

“Generally, it does not end with tenants staying,” he added. “But if you have a chance, it is to come together as a tenants’ association.”

Last week, tenants sent a letter to Slate Property Management with 15 requests, including appeals to postpone renovations until apartments are empty, to give tenants longer notice that a lease will not be renewed, to allow tenants to break leases, and to assist tenants with finding new housing. The developer has not responded as of Wednesday, according to tenants.

Dulik told the Rag that until legislation such as a “good cause eviction” law is passed, market rate tenants in New York City will continue to be at the mercy of unregulated rent increases and unexplained denials on lease renewals.

A “good cause eviction” bill failed to pass the state legislature as part of New York’s budget last year; it is currently stalled in a state senate committee. The bill would require landlords to demonstrate a good reason for evicting tenants in market-rate housing. It would also protect tenants from exorbitant rent hikes and allow individuals to advocate for repairs without the fear of landlord retaliation. Evictions would be allowed, but only when a tenant has not paid rent or is causing a nuisance, or when a landlord wants to take over the unit as their or their family members’ own place of residence.

Those who must look for new apartments right now face a very tight rental market. In 2023 the city’s apartment vacancy rate was just 1.4%, the lowest in the five boroughs since 1968, showing ”just how drastically home construction lags behind the demand from people who want to live in the city,” reported The New York Times.

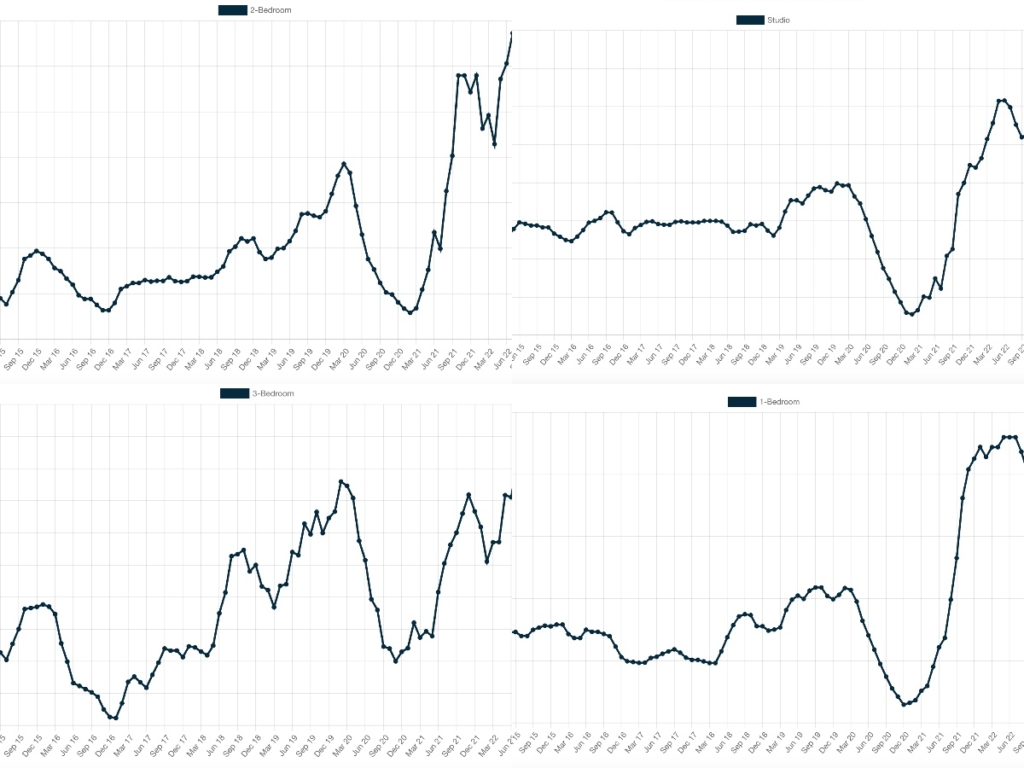

On the Upper West Side, while rent prices have ticked down slightly from their high point in 2022, properties are still significantly more expensive since the COVID-19 pandemic.

Here are graphs from RentHop that show the changes in prices to studios, one-bedrooms, two-bedrooms, and three-bedrooms on the Upper West Side over the past years. All of which show a steep increase starting in 2020.

Residents at 600 Columbus Avenue who have been given the opportunity to stay in their apartments are grappling with the cost of a raised rent compared to both the cost of moving and the likelihood of finding a more affordable rent in the city.

“I was grateful to have the option to not move because we were so exhausted, and it is a huge financial strain. The raised rent is ridiculous but when you calculate the cost of moving, broker fees, and the new rent — it might not be so different,” the resident said, who said their rent at 600 Columbus Avenue rose by nearly 60 percent.

Subscribe to WSR’s free email newsletter here.

Many thanks to West Side Rag!!!

This is such an important story – something that the old Village Voice would have covered but now these issues are completely ignored.

I’d appreciate if WSR would get commentary from elected officials (especially Mark Levine) who keep saying that more affordable housing is needed – but conveniently ignore all the housing that is lost or at risk such as in this case.

Mark Levine is very clear & correct on the only way to solve this – build more housing so that landlords are not able to push through rent increases like this. We’ve under built housing in NYC for decades and now rent prices are hitting all time highs

UWS Dad,

Tons of residential buildings going up – all luxury high-rises.

The City and elected officials enabled use of land for unfettered luxury development.

It is disingenuous for Mark L etc to keep saying more affordable housing is needed when they’ve allowed the current situation

So true and they are pushing to do it again. Busting zoning rules and pushing for more tax breaks and grants and other goodies for developers. They claim it will result in more affordable housing but they don’t mean it and never do.

New buildings are certaintly expensive but what they do is absorb the demand from people who can afford them and make it so that older buildings like the one in this article have less to gain from evicting existing tenants. Some areas of NYC (eg. Hells Kitchen, already gentrified areas of Queens/Brooklyn) are still zoned for ridiculously low rise development given the existing high rents and closeness to subway stations

Exactly!

Leaving aside “Billionaire’s Row” which is a whole different situation nearly all new construction in Manhattan is fully sold or leased in a year or so.

Far as new construction on UWS huge numbers of residents of said new buildings actually lived elsewhere in area.

Are you looking for a job with REBNY or the Adams administration.? Trickle down doesn’t work in the economy or housing!

This isn’t ‘trickle down’ this is basic supply and demand. Don’t care for Adams, I am just so tired of watching dear friends decide to move away because they can’t stomach paying these absurd rents

Why does the affordable housing have to be on the expensive UWS? People who can’t afford market rates in the geographical area they prefer have to compromise and take what they can afford in another area. That’s life.

Misses point completely. Not a market rate story – a story about booting people paying market because they want to renovate. Booted out of home of 25 yrs just because. No option to stay.

I wrote a long comment about this explaining the history of the UWS, but I made the mistake of editing it twice for minor errors, and now it’s been marked as spam and hidden.

But basically, the UWS has always been a mixed income neighborhood, and there are already myriad affordable housing buildings here (NYCHA, HDFC, Mitchell-Lama), though the waitlists are very long. Most were built in the late 1960s- early 1970s, when our gov’t actually cared about creating affordable housing in NYC.

(This was my original comment. At the risk of looking obsessive, I’m going to try posting it again).

Why does it matter if the UWS is expensive right now? Neighborhoods go in and out of fashion over the decades, and the fact is, the UWS is historically a mixed income neighborhood. Central Park West and Riverside Drive were the only well-to-do thoroughfares (with some exceptions dotted up and down Broadway — grand old buildings like the Ansonia). Everywhere else was inhabited by a diverse mix of regular working folks, from college professors, arists, and other intellectuals, to Puerto Rican immigrants, to working class whites.

In the late 1970s – 1980s, the neighborhood deteriorated during the city’s financial and crime crises. Crackhouses, burnt-out buildings, and vacant lots took up much of the real estate. Apartment prices plummeted. CPW remained relatively expensive, but people thought you were crazy if you bought an apartment on Riverside.

When the city started making a comeback in the 1990s, the UWS did too, and eventually it became the expensive neighborhood it is today. But there are still dozens of affordable housing buildings of various different types (NYCHA, HDFC, Mitchell-Lama). Most were built in the late 1960s – early 1970s, when there was actually a collective will to build affordable housing in this city.

I live in an HDFC affordable housing building across the street from 600 Columbus Avenue. I inherited the apartment from my grandmother, who bought it for $15,000 back in 1990. The building was completed in 1972, IIRC.

The point is, the UWS has always been a mixed income neighborhood, and there is a history of building affordable housing here. So I don’t see why we shouldn’t resume building affordable housing here, just because the neighborhood happens to be expensive right now.

I know plenty of people who moved from UWS to other neighborhoods in NYC for lower rent and/or more space, or who stayed and accept the tradeoff of a smaller apartment in order to be in more expensive neightborhoods like UWS. They don’t deny the reality of economics or expect government legislation or media covererage or public outrage to save them. And frankly that is how neighborhoods outside of UWS grow. The truly altruistic and humanitarian UWSers should not be fighting to keep wealth in and add people to UWS. They should be embracing the opportunity to lift the tide of all of NYC. When money is spent in other neighborhoods for housing, rent, and shelters, that creates jobs, stores, and services in those neighborhoods. Fighting UWS market rents is selfish for the renter and selfish for NYC.

Another trickle down crusader. Ridiculous.

The amount of construction in NYC has been far below the influx of people who have moved here in the last two decades. A few dozen highrises are a drop in the bucket. Land is so expensive that the only way to make a return in Manhattan is to build upscale.

Like it or not the property belongs to the owner of the building, not the renters.

The landlord is not running a philanthropy. The landlord’s obligation is to maximize its profits and it is not under obligation to provide apartments in perpetuity at the same rent if it feels the market can generate higher rents.

It seems to me the landlord is acting legally, rationally and morally.

They are acting “morally?” Whose morals would that be, exactly? Yours? And what sort of people are the 34 who “upvoted” this post?

While rent increases are legal, short term rentals are not. Renting out units to another company that in turn signs short term leases seems fishy and should be investigated.

30 day leases are absolutely legal per zoning regs.

The landlord has no obligation to maximize profits. What a ridiculous thing to say. It’s a choice to evict people and push rents much higher, and it’s not a moral one.

Thanks, Laura.

The obtuseness of some of these remarks appalls me. Rent gouging has destroyed this city, deprived people of decent accommodations, forced to use up to 50-70% of their monthly incomes for rent, pushed many people out of the city, pushed out small store owners.

For me it boils down to this: bad leadership on the city and state level for decades.

To be fair, while a landlord does not have any obligation to maximize profits, a corporation does. Those rent increases are ridiculous though

A corporation does not have a duty to maximize profits!

You are correct. There is no legal duty on a corporation or any other entity to “maximize” their profits. But, let’s be real. These corporations and entities the purchase real estate usually have investors and those investors want the highest return on their investments and, if the investor don’t get the “highest” return, they won’t invest in that corporation again and will invest their money with some other corporation that will.

So, while you are technically correct, we all know that isn’t how the investment game works

Since you’re so bothered by landlords trying to maximize their profit I recommend you buy an apartment and charge your tenants below market rents.

Oops! My landlord does. Some actually care about people before profit. But I’ll admit that’s rare.

Two good friends of mine are doing exactly that in Brooklyn. And another friend has a landlord who hasn’t raised rent for about 3 years for her, because she has had to be outside of the US for work a lot . It’s possible to care more about your tenants than your profit. It’s a moral choice.

I call BS on all of that. It’s never a purely moral choice. It’s a financial choice, masquerading as such, while actually taking other variables into account – all tied to “profit”. The risk associated with an unknown new tenant, the time to re-list and without having a tenant in place,, the current market strength in the area, etc.

Take all these variables off the table, and watch your friends take X from person 1, when they could take X+30% more from person 2 – all else equal – for purely moral reasons. It’ll never ever happen.

Your friends made an economic choice to do what they want with their money. Just as any one should be able to do.

Have you considered that the landlord might have partners or investors who provided funding for the purchase of the property? They have a right to expect that they’ll get the maximum return on their investment, no?

No! Return yes; maximum return no.

Something tells me you haven’t talked to the landlord’s shareholders and lenders, who are the only ones deciding if this would be an obligation or a choice. And something tells me they’d agree with Otis.

Unless someone proves illegal practices, if Johnny will pay $8,000 for something Peter pays $5,000 today, what does the fake moral outrage have to do with anything? Every tenant in the history of bricks and mortar has had a sob story of immense proportions. And if they’re truly paying a market rent today, and not some remnant of times past, they’ll have no trouble finding another market-rate place elsewhere.

Except as the story says it’s currently the tightest rental market since 1968 with less than 1.5 percent vacancy. You don’t care that some private equity-type firm wants to turn a residential neighborhood building into a corporate hotel, because it’s legal and there’s a profit to be made by someone somewhere?

If it’s a tight rental market, the government should be incentivizing more housing being built. Instead the government disincentivizes housing being built, because they keep adding on more and more operating costs and more and more restrictions on rent and related tenant protections. Then they blame landlords to get votes to deflect from their own failed policies. The enemy is not the landlord. It is bad government and voter complacency.

No, I don’t. Just like I don’t care what you legally do with your legal property. Do you REALLY care? What are you going to do about it? What can you or I do about? Express ourselves on the internet? “Shame” them into not executing their legal financial plans?

I have friends in the building so yea I do care.

“fake moral outrage”

It’s really quite remarkable to me how some people are so incapable of genuine concern for their fellow-humans that they assume anyone else who expresses any must be faking it. What a way to be.

I know, I’m learning. I was “truly devastated” when the corner widget store closed. I was “so heartbroken” when that what-was-his-name-actor died, he was was so great in what-was-that-movie-again…

Now, let’s plaster more hyperbole on the internet about the “inhumane” legal contract termination, so we can demonstrate to the world our deep and profound sense of loss from the situation. I’m full of all kinds of feels.

You noted below that you’re living in a rent stabilized apartment. Now matter how you justify it your fellow UWS neighbors are subsidizing your below market rent with artificially inflated rents.

Perhaps you should show some “genuine concern” for your “fellow humans”.

Landlords are not breaking any laws by maximizing profits. Of course I would like to see low and stable rents but that’s not how market works. Where is the drama?

The human drama are the people — your neighbors –being forced to move.

Whoever told you that life is fair, easy, convenient, change-free, cost-less, friction-proof…?

Do you own this site? Why do they publish 100 of your comments about everything?

I had to move many times because of rent increases. That’s expected in desirable neighborhoods and there’s no drama.

The “market” is created and regulated by society. It’s not our god. And there’s no reason it has to stay the way it is.

Yes, humans just need to stop responding to incentives. Easy peasy.

You just mentioned below that you live in rent-stabilized apartment. So you have no problem to take from “society”? These greedy landlords and the rest of us are subsidizing your apartment discount. Enjoy.

No, Jen, we don’t do that. We don’t question the RS folks. We’re just supposed to just soak up all the wisdom and compassion accumulated from decades of never paying a market-rate rent.

No reason, indeed, except 20,000 years of human trade which have shown that a “free” market, where two willing parties trade in an arms-length transaction, is the best way for society to set up the markets for the vast majority of goods and participants.

Why is it “inhumane displacement”? Granted I wouldn’t want my rent to go up $2k, however it is a landlord right to charge market rate.

Maybe instead of creating a myriad of shelters in the expensive areas, with tenants without any present or future ties to the area, the buildings should have been converted to regular coops thus increasing housing supply for the locals

To your point – ask why the developer of the of the old Calhoun School decided to make it a shelter instead of a condo as planned and approved by the communit?. The resurgence of the shelters on the UWS is all about $- big big money 💰 For those that don’t know the history-it’s a full circle return to the SRO’s that plagued this area by bringing in transient unsettled residents who increased the crime, drug, prostitution and neglect of the community, not to mention the day to day bs residents dealt with. It’s deja vous alll over again.

PS-much of the residential sales market is all cash & driven by either foreign or VC/PE investors. Super tough for most families or 1st time buyers to compete with. This is something government should address via taxation like most other countries – as NYC RE is hands down one of the best investments around;)

Agreed. I am glad to see so many sensible comments here. It is basic economics. Supply and demand. This is why in most of America people beg, borrow and steal to buy their homes – so they have almost full control over their housing costs. And the government provides incentives like various tax breaks for home owners to make this easier.

And you make a great point about the shelters. There is a lack of supply. And some of that limited supply is being wasted on migrant shelters. They could be housed much more cost-effectively in less expensive places, freeing up units for people like those interviewed in this article.

Not only that but there’s another way to look at it. Although people who bought homes locked in their housing costs, they also put their assets at risk if they have to sell during a market downturn. While tenants give up control over their costs, they retain considerable flexibility to react to changing market conditions by easily relocating or buying at a better time. I know people who could have bought many years ago but opted to rent just for the freedom to make a move quickly.

Our legislature is equally to blame. They have done nothing to protect the citizens of NYC and everything to keep the status quo for the developers. This is happening all over. Common sense laws need to be put in place.

Landlords should also shoulder the burden of realtor fees. If landlords were paying the fees, they would think twice about non/renewals and jacking up prices every year.

I’m sorry?

2019 rent laws greatly expanded rent stabilization and made that scheme permanent in NYS. Market rate tenants gained some protections as well.

Condo or co-op conversions – gone

Mitchell-Lama conversions to free market – gone

Ability to recoup expenses for MCI and other work; gone or extremely limited.

Ability to take apartments out of RS – gone

And so it goes…

As for rest of your post, no LLs will not “think twice” about not renewing lease, “jacking up” rent if forced to eat realtor fees. For market rate apartments things will be as they are with every other business; LL will simply roll those CODB into asking rent.

Landlords DO shoulder the fee. And they pay it off by increasing the rent of the incoming tenant, . There are plenty of wealthy people willing to pay

That means the incoming tenant is shouldering the fee, not the landlord

Exactly. That law was pandering optics by politicians to get votes. It does not reduce the broker fee or the cost to a renter. It just makes it less transparent. NYS required the broker fee to be folded into rents. And now people compain about higher rents.

I sympathize with the tenants who are getting priced out of their apartments. But this is nothing new and nothing unexpected. Anyone who rents a market-rent apartment in New York City does so knowing that they’re at the mercy of the landlord, and should go in with the assumption that something like this will happen at some point.

We were not PRICED out we were FORCED out. We were not given an option to stay except “to move out for two months at our expense” while a cosmetic and unnecessary renovation was taking place. Not the same thing at all.

Anyone renting a market-rent apartment knows (or should know) that they are not legally entitled to a renewal lease.

Yep, they’re coming for middle-class folks now. I am very lucky to be in a RS apartment right now; I could probably afford to move out to a bigger/nicer place, but that makes you vulnerable to this kind of nonsense at any time. I don’t want to be randomly hit with a 60% rent increase whenever I finally get to retire.

Shoutout to my old landlord on WEA who barely increased rents year after year, yet kept the place in basically good shape. Too few of those around these days.

Hmmm… let’s say I purchased an apartment to rent out to supplement my social security benefits. I can make a profit of $1000/mo that would barely cover my living expenses, but Sarah thinks it is immoral and I shouldn’t make more than $500… while she herself lives in a rent-stabilized apartment. Interesting take on morality.

In what world are apartments that rent for $4000 to $6000/month considered affordable housing that should be entitled to rent protections? Also why shouldn’t an investor be entitled to maximize the profit in a legal manor, like every other imvestment? Perhaps you would prefer public housing, as if that has gone so well. And we can all subsidize it through increased taxes.

If Good Cause Evictions passes, landlords will be forced to renew leases. A lease is a contract with an expiration date. The state wants to nullify contracts. The only thing Good Cause Evictions will do is increase rents.

Capital is free to travel where it makes the highest return. Investors will take their money elsewhere.

In your scenario, current investors will flee. But new investors also will flee. Meaning less new housing will be built in NY.

A very useful piece of local journalism would be reporting on exactly how many apartments the UWS has added in the last 10 or 20 years. It’s not many! Our leaders have chosen not to build housing for the next generation, and now there isn’t enough housing.

The number has been reported and is actually negative. The department of city planning published a report about this a few years ago, and here is an article about a more recent estimate. https://www.thecity.nyc/2023/08/24/100k-apartments-lost-to-house-conversions/

The debate about this is so fundamentally broken. How many canards have you all heard from degrowth NIMBYs about “luxury development” which is just completely contradicted by the data. As others have noted, in this thread and elsewhere the only solution to a supply crisis is to build your way out of it.

Where would you like to build housing? It’s not like there are big vacant plots of land waiting to be developed. Especially on the UWS. And when a small building is torn down to build a taller one, people complain about that – the amount of complaining around here is ridiculous.

Converting unused office space in other parts of the city to housing is a much more practical idea to increase the housing stock. And again, I am not saying this to be NIMBY. I am saying this because I am pragmatic and using my brain. If I was being a jerk, I would say add no housing, not even in converted offices.

Repeal the FAR cap and build to the same density and scale that created the pre-war coops that make the Upper West Side so desirable and were regulated into oblivion by the 1961 Zoning Resolution.

This is Manhattan! Anti-density activists should absolutely not be given a heckler’s veto.

Josh P.

No doubt you are aware of all the housing lost on the West Side and throughout Manhattan – including units held vacant for building teardown and luxury replacement.

Check out Amsterdam & 89th Street as one example…

Interesting how no one mentioned that 20 percent of the tenants are section 8. Seems like the property owner has fulfilled any obligation to provide affordable housing in this building. If these tenants can afford $5k a month they can afford to move.

And I was right of course….

Digging through ACRIS city provided funding for The Columbus Townhouse via device called “Multifamily Residential Bonds”, something New York City Housing and Development Corp still does today in order to fund affordable housing.

In exchange for that funding original developer of 600 Columbus avenue entered into a covenant with NYC to provide “20%” of low income or affordable housing via federal government (HUD) which explains Section 8

Agreement was entered into back in 1985, bonds were due to retire in 2015 IIUC. Thus by now it would appear that owners of 600 Columbus avenue have fulfilled their obligations regarding low income/affordable housing and or will soon do so. Thus way may be clear to exit Section 8 program.

https://a836-acris.nyc.gov/DS/DocumentSearch/DocumentImageView?doc_id=FT_1560000095356

https://a836-acris.nyc.gov/DS/DocumentSearch/DocumentImageView?doc_id=FT_1630000095363

Disappointed to see uncritical mentions of this “Good Cause Eviction” nonsense. We all know there’s a housing crisis fueled by growing demand and a lack of sufficient new housing in NY over decades.

Good Cause is universal rent control. It will require a court to determine if anyone has to ever leave a rented apartment. Lease renewals will be mandatory. It will require property owners to prove to a court that rent increases beyond some arbitrary limit are justified. Picture your worst neighbor, and picture them as having a perpetual right to stay being your worst neighbor forever.

The #1 fastest increasing operating costs for rental buildings are property taxes. The city calculates area rents. When area rents go up, the city increases property taxes regardless of whether or not the landlord raised the rent. Inevitably, this requires the landlord to raise the rent to keep up with the escalating property tax bill as well as capital expenses.

Then the politicians rant about landlords while trying to buy votes by spending the money raised from above-inflation property tax increases.

Good cause proponents believe universal rent control is the answer. It is not.

It would be helpful if commenters read the article before commenting. The issue is NOT that the new owners are raising rents or not renewing leases, which we all agree they are legally allowed to do. The issue IS that they are going about it in draconian ways and for instance allowing some tenants to renew while others are not even given that option (many of whom have lived in the building for 10+ years). There are no extensions of any kind (even at the higher rents) despite various legitimate issues (like moving in the middle of the school year.) They are non-responsive to requests and emails and are difficult about returning security deposits. And the list goes on. If anyone thinks in this rental market that it’s not life-changing to have to move “unwillingly” and “unexpectedly” should experience it first hand. I just did and I wouldn’t wish it “on my worst enemy.” And you’d better have your finances it ship-shape, have a top credit score, and I hope you are not self-employed or have any school-aged kids.

Emma,

How far in advance of the end of your lease did you find out it would not be renewed?

I also lived in this building. I received a lease renewal offer with a large increase 90 days before my lease was up, as legally required. Frankly, no one in the building should have been surprised by the situation. Before the building was sold, the previous owners switched to a new management company that started to renovate vacant apartments. It was obvious they would want to renovate all apartments to be able to raise rents. I was actually surprised they offered to renew my lease at all. While I moved rather unwillingly, it was definitely not unexpected. And these days, with the rental market what it is and inflation what it’s been, any market rate renter anywhere in NYC needs to be ready to adapt when their lease ends.

I also want to mention, months before I received my renewal notice, the building inquired as to whether I had stainless steel appliances or not, and whether the floors and cabinets were old or new. I assume they made similar inquiries at other apartments. Really, anyone who didn’t see this coming just wasn’t paying attention. I certainly had started exploring my options before the 90 day notice period.

So many brave WSR readers quick to go to bat for the poor landlords and their “shareholders” lol

Residents all over NYC are facing major housing issues – rent increases, dangerous/deplorable conditions, harassment.

And mostly platitudes from elected officials who care chiefly about social justice messaging, rather than helping actual residents.

Here is an example in the East Village

https://thevillagesun.com/taking-it-to-the-banks-tran-tenants-demand-to-meet-with-bad-landlords-underwriters

Apologies for posting twice, but wanted to share some data for folks to digest to understand how real estate taxes are a huge component of rent.

The biggest component of a building’s operating budget — by far — is taxes. We all know the costs of labor, equipment, roofs, elevators, etc. have gone up. But taxes comprise 30-40% of a building’s operating costs in this neighborhood (I’ve been on the boards of three UWS co-ops and seen the books for many more).

600 Columbus Avenue has had it’s taxable value increase by $5.8M over the last ten years, or a compounded annual growth rate of 2.35%. If it weren’t for COVID-related drops in values, the rate would be 3.72%. That’s actually below average for our neighborhood.

https://propertyinformationportal.nyc.gov/parcels/parcel/1012200029

The tax rate is ~12.5%, so the tax bills are now $3.5 million per year. With 166 units, that’s about $21,000 per tenant per year just for taxes (yes there are various apartment sizes; it’s an average).

The annual tax bill has increased by about $736,000 over the last ten years, so that’s $4,400 more per tenant per year over the last ten years. 600 Columbus has below-average tax increases in my experience, but you can still see how these numbers compound over time.

You could have the “nicest” landlord in the world, and they would still have to raise rents because the city basically requires it to pay taxes. That’s a reflection of choices made by our elected representatives.

Your math is correct: the increase in property taxes over the last 10 years breaks down to $4.4k/yr, or $370 per unit per month.

The question is this: how does a $370/mo increase in taxes per unit lead to a $3k/mo increase in rent? We’re talking about $4,000/mo apartments becoming $7,000/mo. That increase alone is $36k/yr — 170% more than the tax bill on the unit for the year.

I could see an increase in rent making sense, but by $3k/mo? You can’t blame that on taxes increasing.

I’m fortunate to have the nicest landlord in the world, and my rent increases literally do correlate with property tax increases (almost to the dollar) and I’ve never seen anything like this.

It’s a good question, and we don’t know the rental history. They may have kept rents low for a long time, and now are raising them because of an anticipated cost. Or they were far below-market for a long time and are catching up. Or they have a big capital project that cropped up — maybe it’s time for a new roof; maybe there’s a lot of facade work; maybe it’s time for a new boiler that can easily cost $1.5M for a building of this size.

Property ownership has lumpy expenses — costs can be relatively stable for years then you get hit with a lot of expenses at once.

@Wake up!- Another good question, I honestly don’t know. I think there have not been enough projects to truly understand the potential cost impact of Local Law 97. My current building has a score of 83 (grade B) and our early projections are $600K – $1M in projects over a few years to make a meaningful impact on LL97 compliance.

600 Columbus got a 63 on their energy score (visible at DOB Now). It’s not hard to imagine they could need more than a few million meaningful energy improvements.

Thank you 72RSD. Do you have any data on what buildings are spending to q meet the new energy guidelines (not sure of the terminology but we all see the A-F efficiency ratings posted)? These costs too have to be passed on to tenants just like they are passed on to owners of condos and coops.

You make interesting points. Many residents don’t seem to equate that someone actually has to pay for all the city services and programs being offered. The city budget is funded by taxes, often real estate taxes. These services are not “free.”

Gus: Outstanding reporting. Could you kindly followup on the Section 8 tenants? Is there a limit on what landlord can charge as market rent for purposes of the subsidity he receives to house users of Section 8 program? Thank you

See: https://www.nyc.gov/site/hpd/services-and-information/subsidy-and-payment-standards.page

Also: https://www.hud.loans/hud-loans-blog/what-is-fair-market-rent/#:~:text=Fair%20Market%20Rents%20and%20Section%208%20Landlords,-The%20HUD%20Section&text=In%20most%20cases%2C%20the%20local,allowed%20to%20charge%20its%20residents.

Thank you. Very enlightening. So looks like landlord can end Section 8 by just raising the rent to some ridiculous level. The section 8 people will be gone.

The landlord has to get advance approval from HPD for any increases. The new rent has to be demonstated as comparable to similar apartments. The Section 8 tenant still pays whatever flat $ HPD has determined is affordable for the tenant. So it is HPD (i.e. taxpayer) who pays the increase.

Not really.

IIRC HUD, NYCHA, etc.. require a “rent reasonable” test for both new and renewal leases. If a LL wishes to raise rent on existing Section 8 tenant he must submit paperwork.

https://www.nyc.gov/site/nycha/section-8/rent-reasonableness-faq.page

https://www.nyc.gov/site/nycha/section-8/voucher-payment-standards-vps-utility-allowance-schedule.page

With the crisis in housing for UWS residents, why isn’t Calhoun being converted to more affordable housing? You don’t see shelters in Scarsdale or Beverly Hills, but seems “ normal “ to take a building on UWS when working families are struggling??

1. Calhoun is landmarked so it cannot be torn down.

2. Calhoun cannot provide “affordable” or “low income” housing without steep subsidies. Taxes and other cost of ownership and doing business alone mean building cannot support anything else but market rate housing.

Above is where deal with non-profit and city to provide shelter housing came into being. That is highly profitable thanks to generous city, state and or federal money.

3. A lower court judge in CA recently placed a moratorium on all housing permits in Beverly Hills until local government creates more “affordable housing”. Ruling caused quite a stir and is of course being appealed.

So to emphasize your point:

Shelter Housing, which is highly profitable to the property owner, is a significant contributor to the ‘affordable’ housing crisis?

The proper way to mitigate this would be to transfer ‘shelter’ housing to areas with lower housing costs, and overall lower costs of living. This would free up significant resources for both affordable and market-rate housing.

How is this even controversial? Except for the people who stand to rake in massive revenue streams from taxpayer-funded scam-programs?

Take that up with those who feel residents of shelters should be housed in same nice areas of city or wherever in great name of “equity” and “inclusion”.

There’s too much tearing down of buildings , scaffolding, digging-up, building ugly soul-less, cheap material-ed buildings. going on in this city. Where does all that torn down building material….. concrete, pipes, electrical wires, etc. go to? Where is the depository? In the ocean? In a big hole in Jersey? In Kentucky? Can our sewer system handle all these tall, ugly, cheap buildings going up? I see buildings – new ones – a few less than 10 years old, that have scaffolding up for re-pointing, leaky windows….cheap buildings! (Build them up as quick as you can and get out of there!!)I live in a building that is over 100 years old. It’s great! Solid. It’s a shame what’s going on with building, building, building in this city.

Nobody was complaining or even grateful when rents dropped 10-25% plus free incentive months during covid. Landlords take risks to provide housing. Rent factors in the cost of those risks.

I feel for these tenants. Landlords have always been difficult but the new crop of real estate investors are cut throats and have no interest in being in the housing business. They are interested in the making money business so short term rentals provide them with a big increase in how much they can charge. It’s appalling.

I want to flag another issue that is working against the interests of middle class residents in New York and that is the unconscionable in property taxes for coops! Developers manage to score major tax abatements that result in luxury units paying much less that your average one or two bee in a middle class building. It’s appalling when one realizes that an owner in a $100 million unit is paying much much less that you are in your one bed flat! This has got to stop!

Here’s another thing about those tax abatements for new construction or renovated condo or co-op multi-family.

Huge numbers of persons buy knowing about abatements, then watch the clock. As time draws near to abatement ending they sell (or try to) in order to avoid being hit with increased property tax bill.

People should always, always, always find out when buying if condo or co-op in question has any sort of tax abatement, and if so when does it expire.

If there are only several years left on abatement then purchaser is likely going to be hit with increased taxes. OTOH if there is significant amount of time (say a few decades), while that does buy some time, decisions still must be made.

Those tax abatements for condos or co-ops sooner or later will end. Once that happens shareholders/owners are on hook for full tax burden.

As for rest of it blame property tax situation for condos and co-ops in NYC/NYS byzantine and archaic property tax system that treats such buildings as rental, not owned housing.

https://www.sidewalkchorus.com/p/property-tax

In terms of rates commercial properties (including multi-family rental) pay most in property taxes. Next are condos and co-ops with single family homes dead last.

A single family townhouse in Manhattan and co-op building say in Brooklyn with same value will see latter pay more in taxes than former. Why is that? Because city’s property tax system favors 1-3 family homes.

Tax increases on multi-family/commercial properties go into effect at once when passed. OTOH by law increases (and or decreases) for 1-3 family homes are phased in over several years and are capped.

This stupid system came into being as best solution in 1970’s Albany and city hall could come up with in response to “white flight” of the time. Idea was then (and still holds today) is to protect “middle class” homeowners. This totally ignores then and now NYC is largely made up of renters with only a small percentage of persons owning their homes.

Ironically. it is likely that this ownership’s decision is DRIVEN by the potential of universal rent control (aka good cause eviction) passing this legislative session, or in the coming years. If there are tenants who have been occupying their units at significantly below market rents in place when UNIVERSAL RENT CONTROL passes, ownership will be locked into operating old apartments that are in need of renovation while their occupants are ENTITLED to lease renewals at below market rents. Does this system sound familiar? An argument can be made that maybe this owner should provide more notice to tenants, but 90 days is legal, standard and more than enough time to secure other housing. Also remember that this legislative session ends in June so they are wise not to want to extend existing below market leases beyond May 31.

The answer to NYC’s housing issue is less regulation, and a more common sense approach to housing. All one has to do is look at what happened during COVID in 2020/2021. When the balance between supply and demand tilted toward more supply, rents decreased significantly and immediately. It’s a basic economic theory (not so theoretical as this was proven out) called “supply and demand”. Combine this with the fact that: tens of thousands of regulated units are sitting vacant because they are not profitable to renovate and rent out (# is growing by the day), housing migrants (#’s growing by the day), increasing property taxes at crazy rates (1/3 of nyc’s bloated budget is funded through real estate) increased insurance costs, eliminating tax breaks to make it feasible to build affordable units, a housing court system that is extremely delayed and heavily anti-landlord, anti-development initiatives by elected officials, costs to comply with local law 97, increased labor, material, energy costs, it is a recipe for disaster. Our elected officials are failing us and ignoring the facts. NYC residents better wake up to the root causes of the City’s housing crisis soon or else more NYCHA level housing coming…aka the worst and most corrupt landlord in NYC.

If persons wish control over their housing situation they should buy, not rent.

Historically and currently majority of persons in NYC rent their housing (about 70% as of recent numbers).

This in good part comes from fact 60%-70% of all rental housing in city is rent regulated, subsided, public (NYCHA) and or otherwise subject to direct or indirect government control. Piling on said government regulations and laws give those renters pretty much same rights as owners.

It is the comparatively small percentage of free market rental housing that suffers the consequences and repercussions of an otherwise overly regulated rental housing market.

One day, due to the advancement of technology and especially A.I., those who could possibly afford the insane rents and costs to own apartments will not need to or want to live in NYC when they work from home or a satellite office where they can live the life someone with a quarter million or more a year income should have. Those making less than a quarter million who, by the nature of their jobs have to go into an office in Manhattan and live within the city or realistic commuting distance, won’t be able to afford to. Certainly not in Manhattan.

If you love what’s happened to San Francisco over the last 30 years, you’ll love what Manhattan is going to be in less than 10.

The Slate group is notorious for doing this in Chelsea and converting their buildings to so-called luxury spaces. This is why there is no affordable housing.

I feel for these people. It sucks to be forced to move.

But if they were paying $4000 to $6000/month for rent as they say it’s hard to be too sad, you can get a LOT for that anywhere else. Lots of great NYC neighborhoods, not to mention a mansion for that anywhere else.

Obviously they’re not poor and must have good income.

Smart thing to do live somewhere for much less for a while, save towards a down payment. Paying 6000 a month in rent is ridiculous. That monthly amount in a 30 yr mortgage gets u a nice apartment.

You’d be surprised!

STPCV has RS apartments going for $3k to well over $4k and are considered “affordable” housing.

https://my.matterport.com/show/?m=gZ539i385Ee

From listing:

2 BED 1 BATH Apartment 03D 19 Stuyvesant Oval , NY

960 SQFT. $4196.71 12 month $4320.50 24 month

Available Now MINIMUM INCOME REQUIREMENT

$143,887.35 FINISH Platinum Finish AMENITIES Open Kitchen

Read more: https://www.city-data.com/forum/new-york-city-housing-lottery/3415775-stuytown-affordable-housing-108.html

That piece of property was an empty lot that housed a HUGE community garden before that building went up. What’s left of that garden was negotiated as our current postage-stamp West Side Community Garden. We didn’t sacrifice those gardens for luxury accommodations.

There people go; living in the past.

That vacant lot was an eyesore and part of what made UWS considered “blighted” back in bad old days of 1970’s.

Developing that land allowed city to gain tax revenue which in turn helps support WSCG among other municipal services.

https://en.wikipedia.org/wiki/West_Side_Community_Garden

Will you sacrifice it for a shelter?

Here is a thought. While disappointing, maybe everyone doesn’t always get to live in the neighborhood they want if they can’t afford the rent/purchase price. I am sensitive to the fact that since I moved here back in 1993, many smaller units disappeared either because they were combined to create larger apartments, or the buildings have been taken down and replaced, but this is life. Since then, many other neighborhoods, including many in Brooklyn and Queens have become quite vibrant places to live. Being priced out of a neighborhood is frustrating but it happens everywhere and becomes the impetus to develop new neighborhoods that were less desirable in the past. When I moved to UWS back in 1993, into a very small apartment, because that is all I could afford, there were streets you didn’t walk down after dark. Instead of complaining and blaming landlords or the city, maybe it’s up to the person to own their situation. Find work that pays more, make other sacrifices so you can put more of your money towards housing to live where or how you want, find roommates, or maybe NYC just isn’t the right place for you and it’s time to consider moving some place else. The frustration I have is that any opportunity for low income permanent housing, for people who can or want to work, turns into a homeless shelter for transients. Talk about Tale of Two Cities!

Anyone interested please file for future reference.

Listing of all “affordable/low income” housing in CB7

https://www.nyc.gov/html/mancb7/downloads/pdf/affordable_housing_db.pdf

Finally just be clear, Columbus Townhouses (apartment building), Columbus Townhouses (row houses) and community garden are all related.

Back in bad old days area known as West Side Urban Renewal site located at 89th Street and Columbus Avenue, (aka “Site 35”) was declared blighted and sited for redevelopment by city.

Property was subdivided into three parts.

On Site 35 A, a 15-story middle- and lower-income apartment building was to be erected (600 Columbus avenue).

On Site 35 B, luxury condominium townhouses were to be built, and on Site 35 C, a public garden was to be constructed.

To get most bang for bucks city did what you see today; mixture of affordable, low income and luxury housing with NYC providing part of financing for residential.

Just read NYP article on 600 Columbus ave. Apparently Section 8 tenants are not going to be displaced. Indeed they are being offered a chance to have their units renovated at no cost to themselves.

Nearly 80% of market rate tenants have signed new leases.

New owners of building are doing what often needs to be done with many older multi-family in city; they are putting money into the place that likely has not seen much or any such investment since it went up nearly forty years ago.

I find it hard to believe 80% of market rate tenants signed new leases given the large rent increases. Perhaps those 80% are in the apartments that were previously renovated and already at the higher rent level.

Do with this bit of information what you will.

“Although approximately 20% of the units have subsidized rent through Section 8 vouchers, none of the apartments are rent-stabilized — and according to nonprofit housing director Charlie Dulik, Slate’s alleged moves appear to be legal. What’s more, 76% of market-rate tenants whose leases have expired have signed new leases in the building.”

https://nypost.com/2024/02/29/real-estate/tenants-claim-landlord-is-forcing-out-their-entire-building/

What you ‘re seeing with 600 Columbus avenue is a familiar and well trod path for NYC multi-family housing . Those who can afford to pay more, will do so. Others who cannot or will not are going to have problems.

Being priced out of housing may not seem fair, but it happens all the time.

I’m not making any arguments about fairness. But I find it really hard to believe people are paying those large rent increases. I lived there and the landlord asked for a 35% rent increase, making the rent on my unrenovated apartment the same as they charged on the newly renovated ones. Who would rationally do that? Especially when if you look, there are apartments in buildings as nice as 600 just a few blocks away where the rents are $1000/month less than they’re asking at 600 now.

A. Neither you nor eye know personal situations of those who chose to remain at 600 Columbus avenue , yes even with increased rent.

B. You’re discounting opportunity costs, time and effort involved in moving house. Some persons obviously preferred to remain where they were for duration even if it meant paying higher rent.

C. This is rental housing, which by nature is transitory, or supposed to be anyway.

People who took renewal at higher rents may not be planning to remain until end of their lives. It will due for now and or until a purpose is served. Things like child or children finishing school, waiting to buy or move elsewhere…..