Dear Subscriber,

Welcome to this seventh edition of the “West Side Real Estate Market Bulletin”, featuring this month’s major issues:

- the midterm election’s impact on our local market

- our local market’s inflation status and outlook

- our local market’s mortgage rate status and outlook

Market Summary

In a startling midterm election development, Democrats pulled a Senate takeover from under the Republican’s noses, albeit by the slimmest of margins, thus dodging Republican capture of both houses and their attendant policies of tax cuts to the wealthy and entitlement cuts to everyone else. Also, it’s interesting to note that Trump-sponsored candidates generally did not fare well, suggesting that Trump’s influence as a kingmaker may be waning.

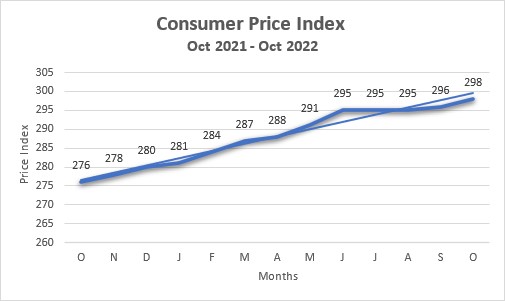

The Effects of Inflation

A shift in consumer spending from luxury goods to staples (food, rent, gas) has occurred this year as the price of luxury goods has gone up along with everything else. (Refer to the “Consumer Price Index” graph below which represents a 7.4% increase for the year.)

Excessive Inflation is the topic that’s been consuming this edition of the Bulletin, and appropriately so, as it could be the catalyst that leads our nation’s economy into a disastrous recession. In the past month or so, gas prices have come down somewhat, which is encouraging, but the annual rate of inflation’s increase has been almost almost 8%, way above the Fed’s 2% target, implying the need for further interest rate increases and heightening the likelihood of recession.

The Fed’s Dilemma

The Fed is faced with a precarious balance: raising interest rates too little will not decrease inflation but raising them too much will lead to recession. After four rate increases this year the Fed appears to be leaning towards the latter option so some degree of recession appears likely next year.

What Do the Tea Leaves Say?

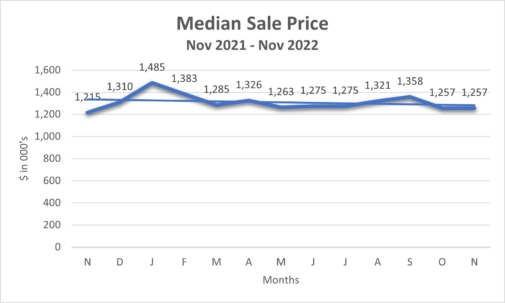

The tea leaves say that the real estate market is fraught with downside risk; adopting a “waiting in the weeds” strategy seems appropriate for the occasion.

For our purposes the tea leaves are the graphs of “Median Sale Price” and “Supply (Open Listings)”. Both of these metrics indicate a persistent softness in the market: prices are weak because of a lack of buyer demand in the face of uncertain price moves, and open listings are low because sellers are unwilling to accept lower prices for their units.

All data courtesy of Urban Digs

What’s Next?

Are you considering buying or selling an apartment in the coming year? If so know that we’re facing a volatile economy that could shift in the wrong direction at any moment, but this is not all bad news. Some very good deals can be scored in a down market if one is vigilant, adequately prepared, and resourceful.

If you’re interested in learning more about this intriguing option, just click on the link to review methods for identifying and transacting exceptional down market deals.