With increasing frequency, I am being asked how the market is doing…more than ever before. And everyone’s uncertainty is evident in their attentiveness to my response. It makes me laugh as it probably means no one was really listening to me before.

With increasing frequency, I am being asked how the market is doing…more than ever before. And everyone’s uncertainty is evident in their attentiveness to my response. It makes me laugh as it probably means no one was really listening to me before.

It is difficult to answer this broadly, as everyone’s circumstances are unique; however, here are my thoughts on where we are.

This could be the beginning of a sentiment change for sellers. The overwhelming negative news for them has been so one-sided that recent hints of more positive news could strengthen their resolve to see this through. Until now though, the only positive had been the super expensive rental market which has buffered the downward slide of pricing. But now, as you can see in this excerpt (below 11/25/22) from David E. Rovella of Bloomberg, the narrative may be changing.

“Beneath the surface of a Wall Street still crowded with bears, some money managers are reacting to the latest signs that a “Fed pivot” has finally arrived (as opposed to all the other times) by renewing bullish bets. As the central bank ties itself in knots trying to land the plane without cratering the runway, investors more worried about interest rates than unemployed Americans are starting to see some light at the end of their tunnel. This optimism is showing up across a range of assets. A rush to corporate credit is favoring the riskier edges of the market, with junk bonds drawing their biggest passive inflows on record. Equity exposure among quants has turned positive and that of active fund managers is back near long-term averages. The inflation bid is crumbling, with the dollar heading for its steepest monthly decline since 2009 and benchmark Treasury yields down 30 basis points in November. Faith in the Fed restored, investors ended the week with the S&P 500 on course for a second monthly advance. Even Europe’s beleaguered equity index has gained for six consecutive weeks.”

Even if these new green shoots are merely data points for some to craft a conflicting opinion, it will be the precise narrative sellers will grasp onto. This is still indeed “a moment in time”, a short opportunity when everything is still stacked in the buyer’s favor…but, as always, it will be short and it will pass.

Of course, there will be those who disagree, while mistakenly (Ha!) comparing us to the rest of the country. However, throughout my 24-year career, I have found that Manhattan is often counter-cyclical to what happens elsewhere.

These are the highlights as I see them:

- Prices have eased and may ease a bit more. In the coming months though, that downward slide will stop, as competition will come back. Timing the absolute “bottom” of the market is impossible. Manhattan is notorious for having short windows of true buyer leverage and then in the blink of an eye, it’s gone. We’re in one of those moments right now, as the bottom is already forming.

- Competition is virtually non-existent, except for very special properties, a very good position to be in when trying to buy. My opinion has always been that the biggest obstacle for buyers entering our marketplace is competition*, more so than price.

- Interest rates have virtually doubled since the beginning of the year, making financing a property substantially more expensive (approx. 40% more than at the beginning of the year). This, along with inflation and sentiment has drastically slowed the marketplace. So let’s touch on each of these points: Interest rates are higher than before, but not out of control; it’s just not what we’ve been used to and they will moderate. You can tackle this by buying when there is less competition* and refinancing later. It is also important to note that there are alternative financing options (ARMs) that provide lower rates. Inflation is moderating and has begun a downward trajectory. Sentiment, perhaps the most important, will materially improve as we come out of Winter. People will have become accustomed to (and accept) the idea of higher interest rates. They will realize that a high 2 to 3.0 interest rate environment may never ever come back. So if purchasing is a goal, they just need to jump in and they will. And once one does, everybody follows = FOMO.

- As we mount the cyclical slow part of the year on top of all the prior factors, the market will be sluggish until late January, when people reawaken. A momentum will slowly emerge which is likely to build substantially as we hit Spring when I expect the marketplace to be extremely busy and competitive.

- Historically, periods of extremely slow activity, like we are in right now, have always been followed by periods of overwhelmingly robust deal volume. A colleague described this period as “a buyer’s market with no buyers.” This is Utopia for someone seeking to secure a home.

- Manhattan is, by far, more of a “need housing” market than a discretionary market. Consequently, when deal volume slows, it simply piles up and gets unleashed later; that impact will most certainly be this Spring.

- By Spring, people will become accustomed to the dynamics of higher interest rates and realize that they simply “have to move”, whether it be because they have kids, their kids are changing schools, or even leaving the house (downsizing), people get new jobs, get married, get divorced, etc.…life happens.

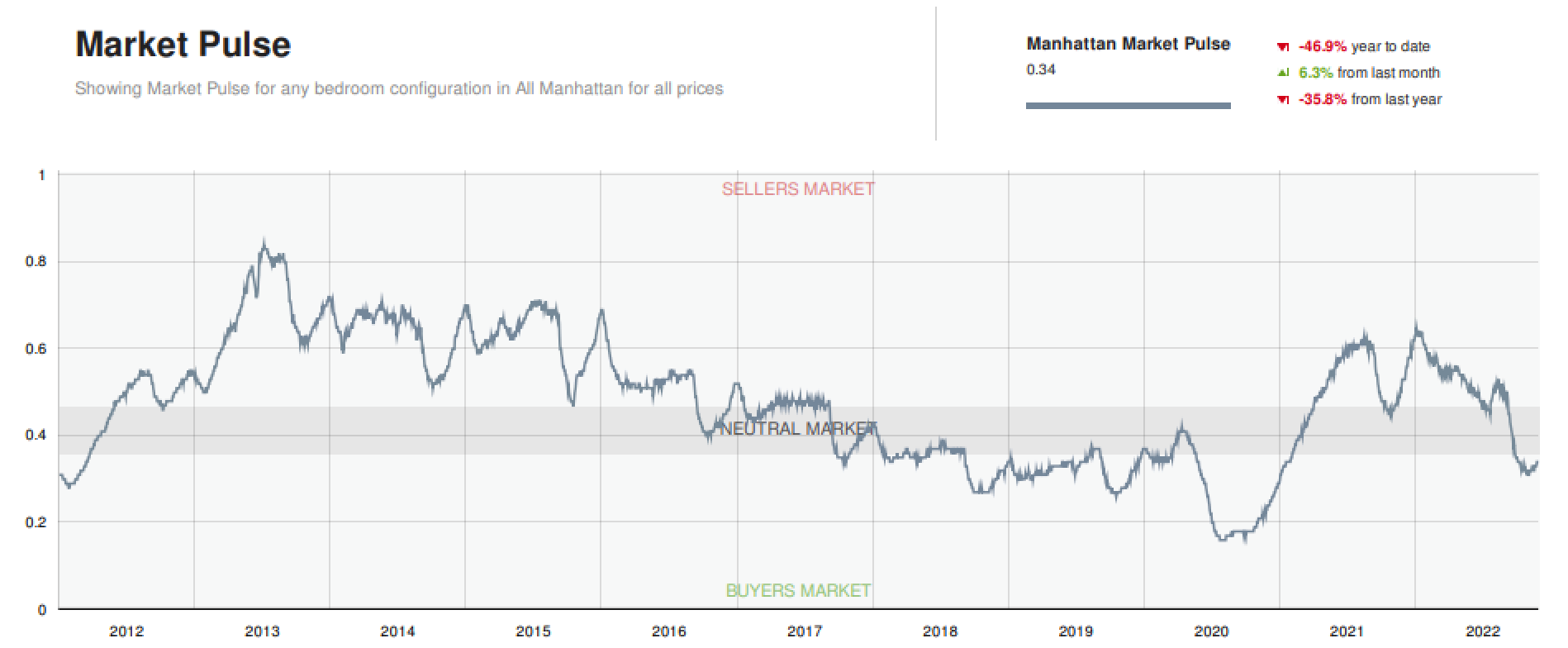

- Objectively, the marketplace has slowed substantially; it’s a buyer’s market at this moment in time (a rare dynamic in Manhattan). Prices have come down 5-10% since the beginning of the year. And they may come down a bit more, another 2-3%; but we do not anticipate much further than that. Limited inventory, especially the pipeline for new development, will serve to resist any drastic drop in valuations. Ironically, the insanely high rental market has served to further buffer greater declines in the sale market, as that alternative is simply too expensive to maneuver.

How we got here:

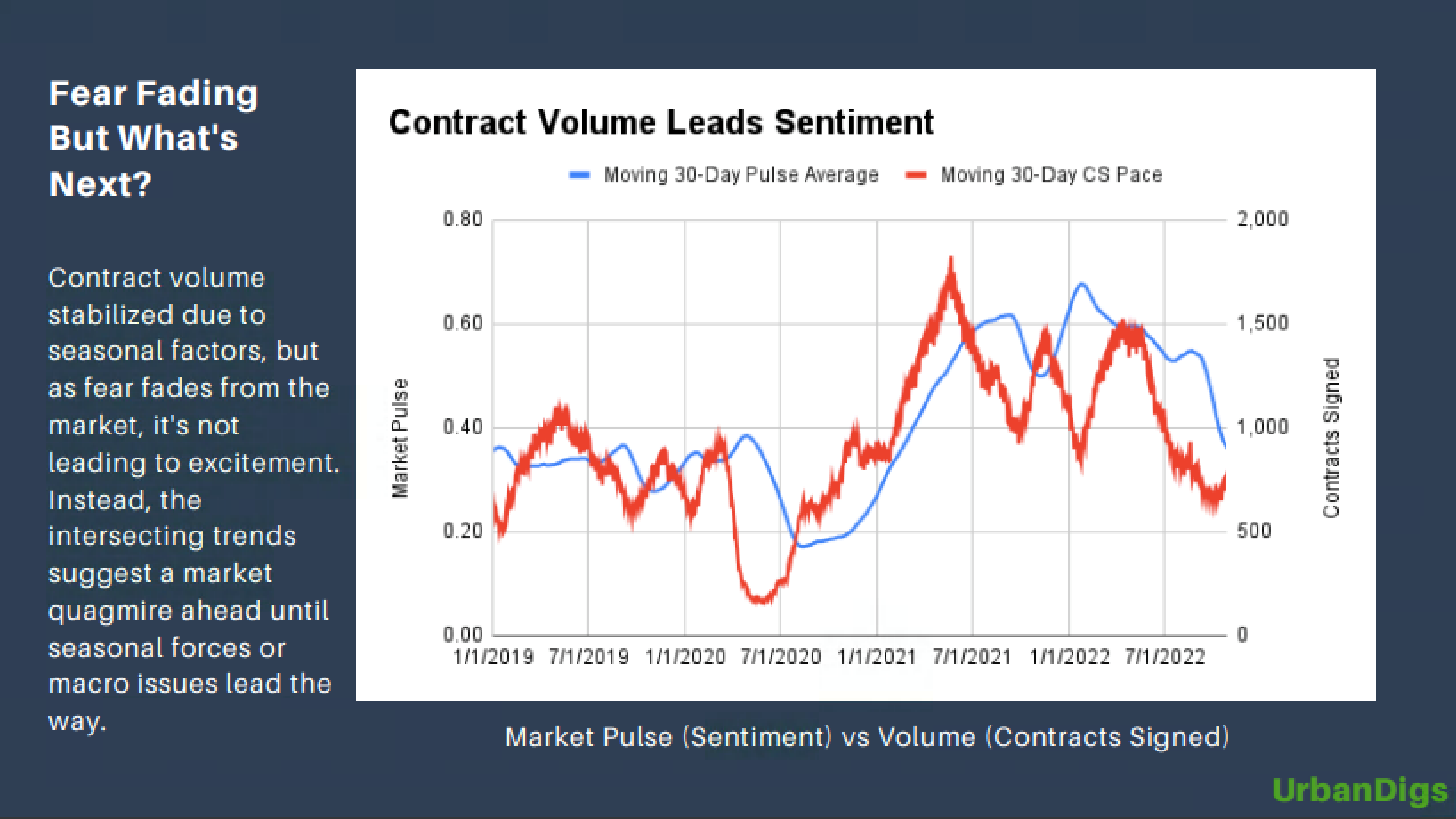

Post-covid the market went crazy in 2021; deal volume was at a level we have never ever seen and are not likely to see again. Entering 2022 the market was still running hot; there was moderate inventory; sub-3% (and/or hovering around 3%) interest rates and palpable demand. However, once the war broke out in Ukraine, we simultaneously began to see a material move upward in rates. These factors combined to create a last-minute scramble for deals; however, by late May and early June, that had all changed…people were checking out. It was exacerbated by the seasonal summer slowdown and the absolute exhaustion of all of the aforementioned news. People were sick and tired of everything and most eagerly jumped into their summer plans to forget about real estate for the summer…except for the rental market, which hit its peak in July. That market has also eased A BIT since but is anticipated again to be off the charts come Spring.

Although there were hopes of a substantial rebound this Fall, it never materialized to the level hoped for. Deal volume has still exceeded the Fall of 2019 (our last “normal” year with which to compare it). What has happened is a drastic “relative” change from the copious deal volume we experienced in 2021…the result has been very poor sentiment.

Below is a video link that will further help paint the picture; it is from UrbanDigs. Noah and John are two of the very best and most objective data analysts who are highly respected by our industry. Click here. Feel free to watch it in its entirety (approx 10 min), but if you are limited in time scroll to 4:20 and watch the second half of the report.

One last time, we are in a “moment in time” where many factors are converging to create this buyer’s market. Your circumstances will be unique and, as you know, I am always around to chat.

As you know, I always say two things: 1) Anyone interested in buying or selling should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them, and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.

Do you want access to ALL Manhattan listings? The REAL ones?

Do you want access to ALL Manhattan listings? The REAL ones?

Click below:

“Connect” with me, as CitySnap was created to present REAL information, provided by the original sources. Manhattan’s most comprehensive search engine for residential real estate. Where the information is actually REAL and provided by the original sources. Join me!