News flash to the old buyers who’ve been kicking the can around; a whole new crop of buyers are entering the marketplace.

To be very frank…you have one year to buy…before all hell breaks loose, as they say. In actuality you have a bit less time than that (perhaps 11 months), as we’re already seeing the cogs of the marketplace begin to turn with a bit more momentum and purpose. Part of this momentum is a direct result of seasonality for sure; but on the ground, we’re witnessing a change in sentiment. Growing numbers of people are populating the dance floor with clear determination and a purpose to buy. Why is that?…several reasons.

- First and foremost, they are aware of my opening statement. In addition to the old buyers, who never bought because the doubling of rates derailed their searches and expectations, new buyershave entered the marketplace, many of them Millennials. Remember what I always say; the greatest barrier to succeeding in this marketplace is not the price (or even the interest rates); it’s the competition. As more people come in, the momentum builds as FOMO sets in. If you think it’s expensive now, it’s going to get even more expensive as time passes…it’s the simple supply and demand dynamic. You have to utilize the one lever that you have, which is the ability to refinance for a better rate later.

- Life happens; people have to move…for the myriad circumstances we all know.

- They know that, although interest rates have not (and may never) retreat back to the 3% levels which spoiled us, real estate in Manhattan is like musical chairs. There are fewer good properties out there than the people who are looking to secure them. At the moment there is indeed, still, a fair opportunity to seize a home; but come next February/March the dance floor will be packed and those opportunities will be ever more difficult to find. Meaning the environment is becoming increasingly more competitive.

- This activity will be driven by interest rates, which have already softened, but will finally descend to a place which will be perceived as “OK”. So the removal of this symbolic hurdle has already been enticing new buyers to participate and that number is going to grow exponentially.

- Not overly consequential, but always a hugely fabricated mental hurdle which amounts to nothing, is the Presidential election. Deal volume is bound to slow, as we approach November, as it always does. But the moment the election is over everything goes back to where we left off. It’s like the rubber necking that happens when you see an accident on the highway. The traffic is moving along normally but then slows down, cautiously and curiously, all the way to the point where you see what has happened and then you quickly get right back up to speed. You get back to the business at hand. So I guess the Presidential election is kind of like a car accident.

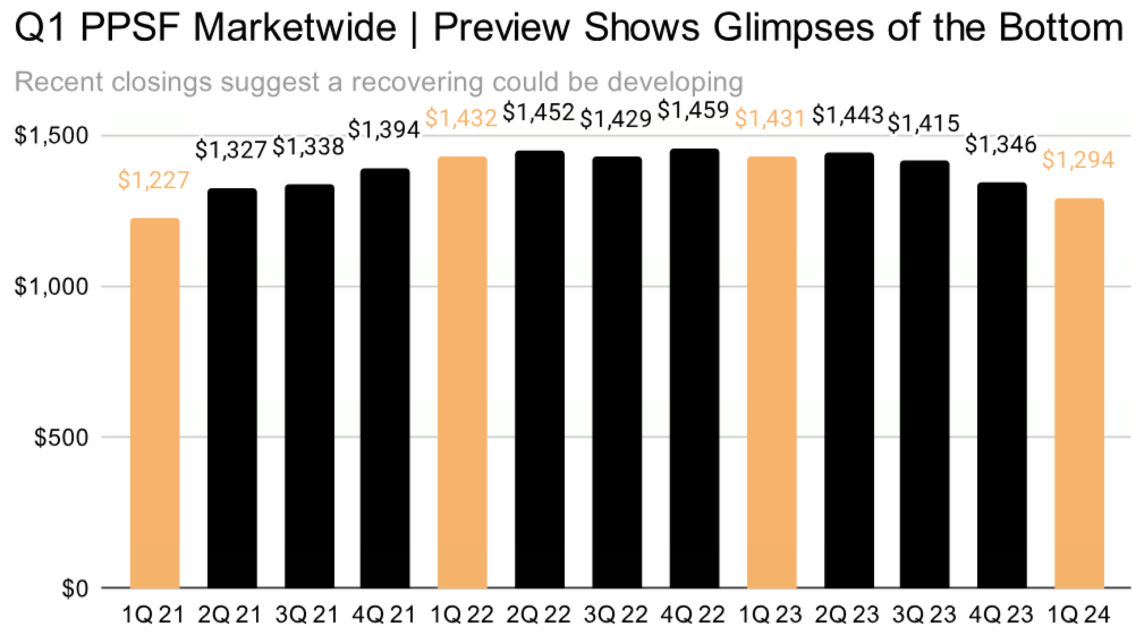

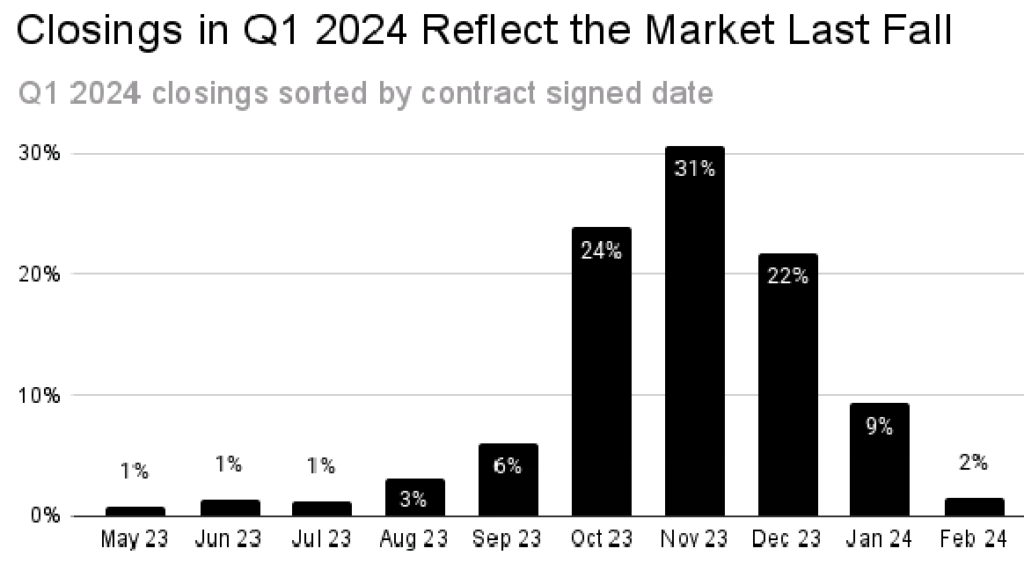

That’s the demand side; it will be palpable. The wild card will be the supply side, our inventory. The severity of the competitiveness we’ll witness will be dependent on the numbers of properties which will actually come on the market. Considering the housing crisis and the lack of new construction in the pipeline, I feel confident that it will not be enough to satisfy. Consequently, we will see substantial upward pressure on prices. With that in mind, for those who have been looking for a bottom, it likely passed us. The pricing bottom appears to have happened in late October/November of 2023. Since that time we have seen increased activity, which is just the beginning of the avalanche we will see in the coming year.

The chart below shows the most recent Q1 closing prices, which recorded the lowest price per square foot in three years. The following chart shows when those deals were actually struck, meaning when the contracts for those deals were indeed signed; the bulk occurred in November, when prices seemingly bottomed.

Final thoughts:

Although we’re currently experiencing very solid activity, if you’re a seller and you’re not in a “must sell” situation, you might even consider waiting a year when demand is pumping.

If you’re buyer and you’re not ready…well, you’re not ready. But if you really want to buy…get ready.

Will you be at “home” next year?…or will you be cursing yourself?

I always say: 1) Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them; and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.