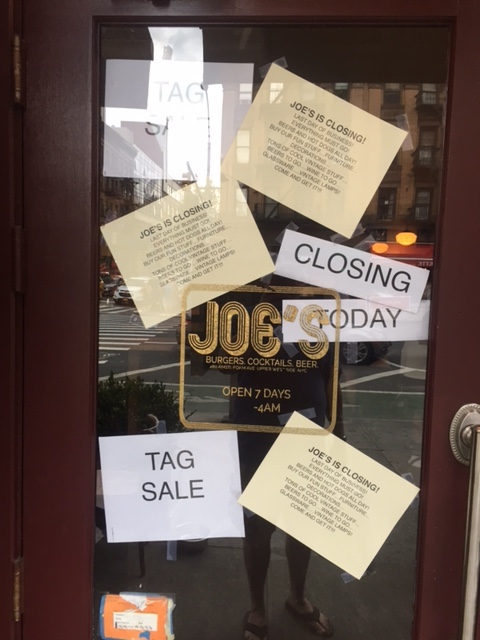

“Closing” signs are becoming all too common on the UWS.

By Carol Tannenhauser

On October 22nd, the City Council Committee on Small Business will hold a hearing on the Small Business Jobs Survival Act (SBJSA), a bill intended, in its own words, “to give small businesses rights in the commercial lease-renewal negotiation process.” The hearing will take place at 1 p.m., in the Council Chambers at City Hall, and is open to the public.

The SBJSA has the dubious honor of being “the longest-pending legislation in New York City Council history,” noted The Villager. Yet, it is still as relevant — and controversial — as it was when it was first introduced in 1986, by then Council Member Ruth Messinger. The bill begins:

The Council hereby finds that the City’s small business sector remains vulnerable at a time when New York City is more dependent than ever on small businesses for job growth and revenues. The New York City commercial rental market has been negatively influenced by speculators for such an extended period of time that the interest of small businesses and job creation, and the broader general economic interest of the City, are being harmed.

An unacceptable number of established small businesses are being forced out of business solely as a result of the commercial lease renewal process. The present commercial rental market provides no means for tenants to mediate disputes between tenants and landlords to arrive at fair and reasonable lease renewal terms. The absence of legal protection for the interests of commercial tenants in the lease renewal process has unnecessarily accelerated the closing of small businesses and resulted in lost jobs, tax revenues and community instability.

It is the intent of the City Council, through this legislation, to be known as the “Small Business Jobs Survival Act,” to give small businesses rights in the commercial lease renewal process, and therefore, a measure of predictability of future costs through a two-step procedure of mediation and, if necessary, arbitration for negotiating commercial lease renewals and rentals. This process would create a fair negotiating environment, which would result in more reasonable and fair lease terms to help small businesses survive and encourage job retention and growth in the City of New York.

Upper West Side Council Member Mark Levine, a co-sponsor of the bill, acknowledged in a telephone interview that lease renewals and rents are not the only reasons small businesses close.

“The internet of course has changed retail dramatically,” Levine said, “and that has led to a real change in the retail landscape of New York City. But there are times when a mom-and-pop business is pushed out upon lease renewal, simply because the landlord has an ambition for a dramatically higher rent, even if the existing business was thriving and an important part of the cultural fabric of the community, paying its rent on time and in other ways a great tenant. What the bill we’re hearing will do is level the playing field in those negotiations, so that when you have an existing small business that is succeeding, they have a fair shot at renewing the lease at a cost that is not prohibitive.”

“Small businesses helped to build New York City, and they continue to play a critical role in providing goods and services, and employment,” emailed Council Member Helen Rosenthal, who is also co-sponsoring the bill. “On the Upper West Side, we have seen a number of small businesses close because they have not been able to renew their leases for a variety of reasons, and our community has really felt this loss. [The Small Business Jobs Survival Act] offers real pathways for commercial tenants and landlords to continue their lease arrangements, and for businesses to stay in their local communities.”

Levine expects the hearing to be “intense.”

“Someone from the Administration will be speaking, followed by questioning by the Council,” he said. “Then, there will be members of the public. I think we’ll hear from small business owners who are suffering from rising rents. I think we’ll hear from regular New Yorkers who are distressed at the loss of mom-and-pop businesses in our neighborhoods. I think we’ll hear from building owners, who also have an important point of view.”

John Banks, president of the Real Estate Board of New York (REBNY), recently wrote an op-ed in Crain’s, summarizing that point of view, calling “rampant” retail vacancies a “myth,” and criticizing the SBJSA.

“Beyond questions of its legality,” he wrote, “the City Council’s proposed legislation mandating 10-year leases won’t change small-business failure rates, which have been consistent for 20 years across all categories. This commercial rent-control bill ignores the growth in pop-ups and short-term leases as creative responses to the rise of e-commerce and would further restrict market flexibility.”

Proponents of the bill bristle at the characterization of it as “commercial rent control.”

“The SBJSA is not commercial rent control at all,” argued Kristen Theodos, a spokesperson for TakeBackNYC, a coalition of small business owners and residents advocating for the SBJSA, in an op-ed in Kings County Politics. “Rather, it is a bill that gives both parties rights in the lease renewal process.”

NYC Council Speaker Corey Johnson ran in part on a pledge to give the SBJSA a hearing. This will be its ninth in the past 32 years, but in none of the prior hearings did it make it out of committee to a vote before the full Council. Johnson is determined to change that.

“As Speaker, protecting and preserving mom-and-pop shops and restaurants is one of my priorities,” he told WSR in an email. “I am looking forward to the thoughtful and comprehensive hearing that this bill deserves. This hearing will provide an opportunity for stakeholders to provide testimony, so we at the Council can discuss crucial issues related to the legislation.”

“John Banks, president of the Real Estate Board of New York (REBNY), recently wrote an op-ed in Crain’s, summarizing that point of view, calling “rampant” retail vacancies a “myth,” and criticizing the SBJSA.”

A MYTH! These guys are liars!

Here’s a current article:https://www.theatlantic.com/ideas/archive/2018/10/new-york-retail-vacancy/572911/

“There are at least three interlinked causes. First, the rent, as you may have heard, is too damn high. It’s no coincidence that retail vacancies are highest in some of the most expensive parts of the city, like the West Village and near Times Square. From 2010 to 2014, commercial rents in the most-trafficked Manhattan shopping corridors soared by 89 percent, according to CBRE Group, a large real-estate and investment firm. But retail sales rose by just 32 percent. In other words, commercial rents have ascended to an altitude where small businesses cannot breathe. Some of the city’s richest zip codes have become victims of their own affluence.”

“Many landlords don’t want to offer short-term leases to pop-up stores if they think a richer, longer-term deal is forthcoming from a national brand with money to burn, like a bank branch or retail chain. The upshot is a stubborn market imbalance: The fastest-growing online retailers are looking to experiment with short-term leases, but the landlords are holding out for long-term tenants.”

I’m a liberal Democrat who values and supports small businesses. But I also believe in capitalism. I don’t understand why we have to be doing special favors to these small businesses.

That being said, I would support a measure to penalize landlords for leaving stores empty for years. This is a major eyesore and destroys the neighborhood. Many landlords don’t renew small businesses because they are irrationally hoping a national brand will fill the space at a much higher rate.

If a store is empty for more than a year (one month Halloween pop-up stores don’t count), there should be a meaningful penalty. Then landlords would need to reconsider their plans.

@Leon – Good idea in theory but that line of thinking will penalize real estate companies that try hard and fail to secure a tenant. What if it’s in an undesirable location? What if there are inherent problems with the rental space?

“I’m a liberal Democrat who values and supports small businesses. But I also believe in capitalism. I don’t understand why we have to be doing special favors to these small businesses.”

But Leon, we ARE CURRENTLY doing special favors to their landlords. Just read about all of the depreciation claimed on these buildings, as they RISE in value.

Residential rent regulation has been a disaster for NYC (except, of course, for the entitled and greedy people who live in these apartments).

Commercial rent regulation will be an even bigger disaster for NYC.

The world changes and the economy changes and there are numerous reasons that small businesses close that have nothing to do with rent.

The government should not be propping up weak and inefficient businesses.

Sherman,

You moved into a neighborhood and proceed to spread your hateful lies about your neighbors (” the entitled and greedy people who live in these apartments” and “weak and inefficient businesses” in just this one comment). By now most of us are familiar with this tactic being used on the internet to spread division and hate. You are now exposed. The 2 replies above point to the decisiveness of your comments.

Try to be a better person, and stop trying to sow discord in our neighborhood.

good point, Dannyboy.

Sherman moves here and brings all his prejudices and narrow-mindedness with him. Then, he rants continually because not everyone in the neighborhood will conform to his own prejudicial thinking.

Bruce E Bernstein responding to dannyboy to agree about someone else ranting continually. Pot. Kettle. Black. You two have a wonderful little mutual admiration society going. I tend to be closer in policy to you than Sherman but that doesn’t make you right…

“I am also trying to find a better way to communicate” – Leon

Well, you certainly have a failure to communicate now.

You posted 3 Comments on this Post. In the first, you received 2 Replies, but your “better way to communicate” caused you not to respond. End of that Discussion.

For your second and third Comments you chose to just criticize the tone of other commenters who are actually discussing the merits of the SBJSA. Again you prefer to shut down the conversation, rather than discuss it.

You bolster your non-communicating “better way to communicate” you throw out false accusations. For example, “you seem to think that wsr is your personal domain”. Now Mr. “better way to communicate” I know that I have commented on 2 of the 12 WSR articles recently, so that’s false.

Your better way of communicating is failing. So what do you think of the proposed bill meant to help stop small business closings?

Bruce,

I agree with you that his statement is wrong and I don’t really like it. But you and Dannyboy shouting people down by posting over and over and over again is really overkill and makes me almost feel bad for him. The two of you seem to think that wsr is your personal domain.

At some point, repeatedly telling someone how wrong they are is not going to change their minds but rather will make them hold their beliefs more strongly. Republicans got tired of know it all liberals telling them how horrible they are and just dug in their heels against us. I personally think this makes them even more horrible but I am also trying to find a better way to communicate and object because this way really doesn’t seem to be working as our country moves further into a death spiral.

Liberal Leon,

Dannyboy and I were objecting to the following statement by Sherman:

“Residential rent regulation has been a disaster for NYC (except, of course, for the entitled and greedy people who live in these apartments).”

if you are really as “liberal” as you say you are, you, too, would find this statement sickening. but apparently you want to attack those who are complaining about this.

Maybe your frequent assertions of “liberalism” are just a convenient rhetorical device.

Greedy? What’s your problem sir?? It’s the real estate developers and landlords who are the greedy ones. Inch by inch slowly turning our city into one big tourist attraction. Surely, you are not a native New Yorker to have such strong opinions about affordable apartments, etc. They are also selling their multi-million condos to mostly foreigners!! You sound just like a Republican traitor and probably voted for Trump.

If the landlord didn’t get tax breaks on an empty retail location he would lower the rent to keep a business rather than holdout for a long term lease from a bank or large retail chain!

@ Diane Mardini

I’m a CPA and what you’re writing is absolute nonsense but keep believing this ignorant myth if it makes you happy.

Sherm

Landlords do not get tax breaks for having an empty storefront. Repeating this falsehood will not make it true.

Agree wholeheartedly about not propping up failing businesses. The goal is to allow thriving businesses in a given sector to survive. What may be “market rent” for a large chain like Duane Reade, is not the same for a shoe repair sole proprietorship. What we are left with are stores sitting empty so a landlord can combine them into a big space to appeal to chains that can pay exorbitant rents because an individual store does not need to be profitable to the same extent a single mom-and-pop store does. It ruins the community. There are no shoe repair shops, hardware stores, and other small local businesses that are necessary to make a neighborhood. I don’t know that I favor terms around the lease or rent caps, but there are many things you can do to promote the growth of mom-and-pop stores and dissuade non-descript chains from taking over. The same way many suburban neighborhoods have zoning laws to prevent your neighbor from building a shed two feet from the property line, or adding a third and fourth level to their house to block your view. People live in NYC for diversity, the UWS is beginning to look like any suburban mall.

I am entitled and greedy? You are narrow-minded if you lump those of us who’ve helped renew these neighborhoods by sticking by them for so long into the same small bucket of envy. I take quite personally these kinds of attacks. I contribute just as much to my community as most of my far wealthier neighbors do. Some do absolutely nothing for the neighborhood, actually, except drive up the cost of living.

Martha, good for you.

Sherman is routinely nasty and likes to provoke. He frequently says very abusive things about whole classes of people: rent stabilized tenants, minority parents with children in public schools, and so on. Anybody where he feels he has license to feel and act superior.

On the one hand, he deserves pity because of his obvious anger and insecurity. On the other hand, many of his false narratives are accepted by too many other people. So “props” to you for confronting this and not letting him get away with it.

Rent stabilization would not be despised so much if many of the loopholes were eliminated. We have all heard the stories of the yuppies who used a loophole to inherit the rent stabilized apartment from their parents, or the families that pay nothing in rent but have multi-million dollar vacation homes, or the families that needed help when they were starving artists in the 60s but are now worth millions and are more than capable of paying more.

Rent stabilization is a wonderful thing for older people on fixed incomes who moved into the neighborhood years ago when it was not nearly as desirable. Those of us who dislike rent stabilization are not ogres who are looking to put grandma the retired public school teacher on the street. We are looking to curb abuses. Perhaps if you could help with those efforts, you would have a lot more friends in the community.

Juan, you provide a good explanation with this comment.

But…

My argument against these revisions of Rent Regulation is that once these revisions begin, there will be, for sure, further revisions and further weakening.

I will explain myself, as you have. Because rent regulation helps maintain rent prices, they enable a mixed population to reside in a neighborhood, where in the absence of rent regulation, everyone is of very similar income. I should think that many of the people who complain about rent regulation would want more, if it is lower rents being offered that they are after. That they don’t surprises me.

As to household income determining rents, that poses a problem to those arguing that rent regulation is Socialism and they won’t accept income based prices. For me, I disagree with household income determining the regulated rents as rent regulation is not an entitlement program, nor needs based; it is a way to maintain the balance between landlord demands and tenants’ disadvantage resulting from the housing shortage.

Actually, dannyboy, I have friends, family members and colleagues who have abused rent laws in the way I am describing. So I am not posting based on rumors. And there is a whole cottage industry that enables this, because within the letter of the law, they are often acting legally, but this is not the spirit of the law.

If annual household income rises to above a certain percentage of rent (let’s say 15x or 20x annual rent), rent should revert to something closer to market rate. I really don’t think this is a very controversial statement, but those who have rent stabilized homes seem intent on fighting this idea.

Juan, thank you for bringing me in to this important discussion.

Because you lie so much.

You write: “We have all heard the stories of the yuppies who used a loophole to inherit the rent stabilized apartment from their parents, or the families that pay nothing in rent but have multi-million dollar vacation homes, or the families that needed help when they were starving artists in the 60s but are now worth millions and are more than capable of paying more.”

I know you just tell us what you heard, but you anecdotes are weak and weary.

You show a complete lack of reading comprehension. I made it very clear that I, and many others, am in favor of rent stabilization in many cases. But there are a lot of people who resent it due to the frequent abuses. If we eliminated the abusers, people would be much more in favor of it and would stop scapegoating it.

It is comparable to gun regulations. Gun owners are so obsessed with protecting their rights that they refuse to make common sense gun laws to minimize the impact of the small percentage of gun owners who abuse guns. Similarly, rent stabilized tenants are so worried about protecting their rights that they won’t support common sense changes that eliminate abuses but won’t impact 95% of them.

Bruce, please get off your soap box, and, as I have noted before, go spend some time off the island of Manhattan. We have a horrible problem of this country being really polarized. If you won’t move a little bit towards the middle and listen a little bit, it is just going to get worse. But instead, you are obsessed with proving how clever you are in parsing other people’s words and making witty remarks that will be blessed by your buddy dannyboy.

this comment by @Juan has to be near the top in pompous self-regard. he feels comfortable lecturing @Martha about how rent-stabilization is “despised” and how rent stabilized tenants have no “friends in the community”?

there are 1 million rent stabilized units in NYC. so it can’t be THAT “despised.”

@Juan gives the impression of being a newcomer to NYC who has very limited contacts with people of different backgrounds and walks of life. maybe i am wrong on this, but i am basing it on the one-sidedness of his presumptions on this and other issues.

The business described here is far from weak an inefficient. From the article: “. . . there are times when a mom-and-pop business is pushed out upon lease renewal, simply because the landlord has an ambition for a dramatically higher rent, even if the existing business was thriving and an important part of the cultural fabric of the community, paying its rent on time and in other ways a great tenant.”

What part of “there are times” did you derive a statistical case where high rent was single issue forcing a small retail business to close?

Many of you seem to be yearning for a city that began vanishing in the 1980’s and has continued since.

These small retail businesses either cannot or will not compete in the new internet age.

Recent story about “Eddie the tailor” closing his shop brought out the usual “greedy landlord” cabal. The OP by WSR glossed over and or never mentioned that the LL *did* offer Eddie a lower rent, and he *STILL* chose to close down and retire.

That is happening across the board as older small business owners just don’t see it worth bothering, and their children don’t want the business either.

Reason why you are seeing so many new bars, restaurants, food places, barbers, nails and other such personal service places open because they are one thing you largely cannot do on internet. Everything else is fair game.

of course the Internet is having an impact on brick and mortar businesses. no one disputes that.

but no one except landlord apologists also disputes that the crazy rents being asked in many locations of Manhattan are also having an impact.

there’s an easy way to disprove @B.B.’s claims:

1) there are may vibrant commercial strips without the same vacancy rates and abandonment in lower rent areas in the outer boroughs. I work in Elmhurst / Jackson Heoghts, Queens. Check out 37th Avenue around 78-85th; 74th Street; Queens Broadway from Baxter to Queens Boulevard; Northern Boulevard around 80th Street; and many other areas. In fact, new commercial areas are opening up that didn’t previously exist.

2) Second, this is simply not happening in all cities. The last i looked, the Internet existed in cities other than NY.

@BB said:

“That is happening across the board as older small business owners just don’t see it worth bothering, and their children don’t want the business either.”

Well, of course. but then new entrepreneurs, including many immigrants, open new businesses.

this article gives a better understanding of what is going on:

““It’s not Amazon, it’s rent,” says Jeremiah Moss, author of the website and book Vanishing New York. “Over the decades, small businesses weathered the New York of the 70s with it near-bankruptcy and high crime. Businesses could survive the internet, but they need a reasonable rent to do that.”

Part of the problem is the changing make-up of New York landlords. Many are no longer mom-and-pop operations, but institutional investors and hedge funds that are unwilling to drop rents to match retail conditions. “They are running small businesses out of the city and replacing them with chain stores and temporary luxury businesses,” says Moss.

In addition, he says, banks will devalue a property if it’s occupied by a small business, and increase it for a chain store. “There’s benefit to waiting for chain stores. If you are a hedge fund manager running a portfolio you leave it empty and take a write-off.””

https://www.theguardian.com/business/2017/dec/24/new-york-retail-shops-amazon-rent

You’re wasting your time, BB. You can’t talk logic with folks who by nature are illogical.

Fact you are comparing outer boroughs to Manhattan commercial real estate is laughable. But to quote Jeremiah Moss is just piling on….

What Mr. Moss and your good self seem to be forgetting that this is *NOT* 1960′, 1970’s, or even 1980’s New York City. Back then the place was one most middle class and above were fleeing in droves. That no longer is the case, especially for Manhattan.

In the 1970’s and 1980’s landlords would almost take anyone with a plus for both residential or commercial spaces for various reasons. None of which exist today.

Furthermore you cannot compare the shopping habits of outer boroughs to Manhattan either. The demographics both socially and economically often just aren’t the same. Or are you going to sit there and tell me Elmhurst and Jackson Heights are same as UWS or UES.

Nothing you nor anyone else in favor of “commercial rent control” has yet addressed the root cause high rents; the high and increasing taxes, fees, surcharges that commercial property owners must pay.

Will say this *AGAIN* commercial properties pay a bulk of NYC real estate taxes. They are further preyed upon by a bewildering and vast array of surcharges and fees tacked on by Albany or city hall.

Yet you and others seem to want same as with rent control laws; force landlords to subsidize (or just plain eat any losses) so persons who cannot afford to remain (and or do business) in city without assistance remain doing so.

What you and others also conveniently gloss over is that rent per se isn’t the be and end all of retail’s woes.

Utilities (water, sewer, electricity, etc…) have gone up. Labor costs ditto now that NYC and NYS have raised the minimum wage, mandated PTO and in other ways have turned what were minimum wage jobs into equaling full time employment with a college degree. Piled on are the high NYS and NYC income taxes including that unique to New York, the “unincorporated business tax”.

“Everything else is fair game.”

Love your Big Game Hunting analogy. Captures your attitude well.

Hunt ’em down and kill ’em.

That’s your vision for the neighborhood? Read this https://www.nytimes.com/interactive/2018/09/06/nyregion/nyc-storefront-vacancy.html?action=click&module=Editors%20Picks&pgtype=Homepage

Join us for a Rally for SBJSA 12 noon before the public hearing on 10/22 City Hall steps

David Eisenbach

https://sbjsa.com/

The head of REBNY said ““rampant” retail vacancies a “myth,”.” Take a walk down Broadway and see for yourself. NOTHING this guys says is to be trusted at all, he simply lies.

You know, if the local council person at that time (great person one-to-one by the way) didn’t stick her hand in regulating store front sizes to begin with, the vacancy problem on the UWS wouldn’t be as bad as it is today. The real problem is that government should stay out of this issue, which really ought to be between private parties. Small businesses have a choice, which they’ve clearly opted for, which is to walk away from where they can’t make a profit. The building owners should have that choice also. What’s the government going to do then, when building owners choose to abandon their properties because they can’t make a living because of the regulations that tie them up with failing businesses?

Are we headed back to the “good ole days” if crumbling infrastructure and bankrupted city coffers? The bottom line is the real estate industry generates half of every dollar in the city’s income. Don’t bite the hand that feeds all of us and has made this city so great. It’s lunacy!

I agree that the REBNY guy destroyed his credibility with this – but I think that what this statute really does is make it much harder for a landlord to rent to a small business to begin with. Those who have one in place may be stuck, but those who do not would now have every incentive to say no to a new tenant that would have the right to rely on this statute.

I agree with the commenter above who suggests penalizing for vacancies – that would allow landlords to find the best tenant, but make it untenable to force a small tenant out in the hopes of reaping a windfall in the future. I have suggested before that there be a loss of business treatment for tax purposes (with the related ability to deduct expenses and recognize capital losses) for any landlord whose commercial property is vacant for more than a defined period. Perhaps the period should depend on avaerage vacancy rates, so that when the market is down across the board, landlords are not penalized for what they can’t control.

All in all, capitalism does a reasonably good job of encouraging the markets to serve the current needs of society – but it can be very imprecise in how it does that and brutal and unfair in the distribution of the costs of change. I’d prefer a rule that evens out the process, and gives some protection to those who are harmed by change, rather than action to prevent change to begin with.

Erica, there are many problems with the vacancy tax solution.

it does not aid businesses that are threatened NOW with rent increases.

It does not give the small stores the same level of rights as the existing arbitration proposal.

As stated above, it can end up punitively taxing innocent property owners, for example, those that have spaces in less desirable areas, spaces hard to rent for various reasons, etc.

It definitely helps businesses that are threatened now because it is a behavior modifier. If I am a landlord and there is a risk that I will not find a new tenant and not only will I be getting no rental revenue but I will be penalized for having an empty storefront, I will be more willing to negotiate with my existing tenant than if that penalty did not exist. So the current tenant’s negotiating position improves significantly (assuming the landlord is a rational actor, which is sometimes a big if)

@Carlos:

you are correct, the “vacancy tax” can be a “behavior modifier” on landlords, and thus help existing tenants. and i agree with your analysis of the process. thank you.

however, it is not as direct an effect as the enforced arbitration, which will thus help existing businesses more, and more often.

The reason this has never passed is because it would instantly challenged as a violation of the 5th Amendment’s Taking Clause which says that “private property [shall not] be taken for public use, without just compensation.” By limiting rent terms, the NYC government would be “taking” from the landlord the use of their property by restricting, within an approved use, how they make money from that property but with no compensation for the loss.

While confiscating all public property would create DeBlasio’s desired socialist paradise, fortunately the law still reigns supreme.

Oh, Please! “Taking” is not related to this situation at all. In fact, the proposal backs up the “free market” philosophy with appropriate regard to the common good. Please see “Doughnut Economics” A wonderful book that takes some of the tribalism out of our current conversations.

so why is residential rent regulation constitutional? i fail to see any difference.

I don’t understand why anyone would own a retail business in NYC. You work 6-7 days a week 10-12 a day to just pay the rent. I have looked at some retail rents and can’t see much income left after your rent payment!

This is all so much of the same anti biz folks on the city council and our usual group of self appointed community leaders. I know people have short memories so here is a reminder. The city council passed a law/regulation severally limiting the frontage and with of any store. It also put restrictions on renting several smaller store fronts and combining them into one large one by a bank or large chain store. Take a close look at the stores, on B’way for example that are vacant. They are mostly small and/or odd shapes that do not easily lend themselves to being viable stores. Even a “mom & pop” shoe store needs a large amount of square footage for storing back stock to be a viable biz.

When these new regs were being put in place people noted that this would happen as it had happened on the UES Avenue’s and they were pushed aside in favor of these regulations. The only exception to this was for suppermarkets

Robert said:

“Take a close look at the stores, on B’way for example that are vacant. They are mostly small and/or odd shapes that do not easily lend themselves to being viable stores.”

that is simply false, not only for the UWS but for the many other areas, like the West Village, that have large rows of storefronts lying vacant.

I think the average New Yorker would prefer their local politicians to focus on concrete structural issues rather than pie in the sky social engineering with resultant unintended consequences.

Specifically… where is the oversight on the MTA and whoever picked the vendors that installed the failed bus shelters and (shoddily) renovated our subway stations. These people should be held accountable, and the money/favors that changed hands should be investigated. of course NOT by that sterling example of civic responsibility…Cy Vance Junior.

Just a quick FYI

Its been one of the worst kept secrets at 26 Federal but now the media is running with it The FBI has been investigating him for several months now, for taking campaign contributions that “helped” him decide how to handle certain cases like Weinstein

This problem will only end when they stop allowing landlords to claim an empty property as a loss on their taxes!! If they were peinalized for having an empty storefront, they would be forced to rent at a competitive price and the city’s economy would boom!!

For the love of God, will people stop with that tired old canard?

There is no personal nor business tax deduction that makes anyone whole from leaving business on the table.

Residential landlords don’t make money off leaving apartments empty, but they will unless or until the right tenant comes along.

if you have a portfolio, a loss on one building can offsetprofits on another building. In some cases it might be worth it. Also (and this is not a tax issue), banks are apparently offering higher valuations on buildings with chain store or high profile leases, which can matter to professional real estate portfolio investors.

the great Jeremiah Moss discussed this in an article in the Guardian:

““It’s not Amazon, it’s rent,” says Jeremiah Moss, author of the website and book Vanishing New York. “Over the decades, small businesses weathered the New York of the 70s with it near-bankruptcy and high crime. Businesses could survive the internet, but they need a reasonable rent to do that.”

Part of the problem is the changing make-up of New York landlords. Many are no longer mom-and-pop operations, but institutional investors and hedge funds that are unwilling to drop rents to match retail conditions. “They are running small businesses out of the city and replacing them with chain stores and temporary luxury businesses,” says Moss.

In addition, he says, banks will devalue a property if it’s occupied by a small business, and increase it for a chain store. “There’s benefit to waiting for chain stores. If you are a hedge fund manager running a portfolio you leave it empty and take a write-off.””

https://www.theguardian.com/business/2017/dec/24/new-york-retail-shops-amazon-rent

I am an accountant working in commercial real estate and I will say ONCE MORE that there is NO DEDUCTION, CLAIM, LOSS, BENEFIT for empty space on a federal or state income tax form! Get your facts straight people!

Have you ever considered that the outrageous cost of operating a building here in NYC might be driving rents so high? Ever seen the amount of the checks that building owners have to write to the city? It’s not really rocket science.

Since you’re a CPA working on commercial real estate, certainly you realize that property tax increases are passed along to commercial tenants in standard leases, and thus have nothing to do with the exorbitant rent increases many landlords are asking for.

That is a correct statement and clearly proves my point! I can assure you that when commercial tenants are saying their rent is too damn high, they aren’t exclusively referring to their base rent but including their share of operating and RE Tax expenses as well. It’s all about cash out the door for these tenants so you can call it what you want but its all related to the exorbitant cost of operating a building in this city.

well, @Shakingmyhead, you conveniently changed your argument in the middle.

in your first statement you said:

“Have you ever considered that the outrageous cost of operating a building here in NYC might be driving rents so high? Ever seen the amount of the checks that building owners have to write to the city?”

but then you said:

“I can assure you that when commercial tenants are saying their rent is too damn high, they aren’t exclusively referring to their base rent but including their share of operating and RE Tax expenses as well.”

so first you said that the RENTS were high because of commercial property taxes… then you changed it to that the tenants were not really complaining about the rent but all the costs.

but EXISTING businesses are driven out when the new lease comes due, and the rent is raised by 50%, 80%, 100%. this has nothing to do with escalations in property taxes, as you already admitted. those escalations are already taken into account in their PREVIOUS lease, which they have been surviving under.

basically, the property tax argument is a false excuse the landlords are making. these taxes do add to tenant costs, but, by and large, it is the huge rent increases that are closing down the small stores.

And overall, the tenant proportion of property taxes are small, compared to the rent.

Will someone from the rag be attending? I wish I could go but would like to hear what happens … the vacancies and pushing out of small businesses has completely changed the landscape of the UWS

Clearly the increasing number of small and medium size businesses forced to close because of lack of power in the lease negotiation process favors owners of properties to the degradation of the neighborhoods where small and medium size businesses are forced out of business. It is clearly in the interest of the business landlords to keep these properties empty. Is there a tax-based reason for this rash of closings? The issue needs to be closely looked at by city council and other entities protecting the public from such business practice abuses.

This is misguided. The best approach would be to remove the tax incentives for vacancies. Instead of declaring a loss and not paying property taxes, landlords should pay the full property tax and not declare a loss and take a windfall for an empty store while they wait for a super high rent tenant. This would create incentives to fill empty storefronts legitimately, which would increase availability and thereby lower rents.

I can’t even wrap my head around such an ignorant comment. For someone who obviously reads this blog often, haven’t any of the educated responses about the NON-EXISTENCE of a tax break for vacant commercial space made an impression?

Landlords should NOT get tax benefits for untented space! That is a huge part of the problem

Because rent control laws worked so well for residential, now the city has commercial property in their crosshairs. This will not end well, I promise you that.

Did any of you so happy about this bill bother to consider much ground floor retail is owned by co-op or condo buildings. As such those “greedy landlords” are your friends and neighbors who live above such places. Many such buildings on UWS and elsewhere are barely breaking even on ground floor retail. In best cases there is a small profit and or the rent covers property taxes.

Once again this liberal/progressive city council and mayor are pandering to their base.

Retail including providing goods and services has been upended by the internet. There is no putting that genie back in bottle, and things are only going upwards.

millennials and younger generations aren’t that into “brick” retail. They’ve voted time and time again to use apps, internet or whatever else online over even walking twenty feet to buy toilet paper.

As such what many of these “mom and pop” or whatever small businesses need are rents so below market that it would be ridiculous. Otherwise they simply cannot earn enough to remain open due to low sales per square foot.

Days of opening a store and sitting around kibitzing with neighbors/friends and maybe selling one or two things per day are over.

More and more people turn to internet first, and often find what they want, at an attractive price with free delivery and or returns.

You want to give “small business” a shot at surviving in NYC? Get the city to lower commercial real estate taxes (which account for a majority of such revenues). Do away with the vast and intrusive layers or red tape, rules, regulations, high taxes and other things that make NYC and NYS for that matter one of the most hostile places to open/run a business.

You notice the city council isn’t talking about the recent huge increase in minimum wages forced upon small businesses. Nor PTO and host of other provision laid upon all businesses operating in this city over the past seven years.

“Because rent control laws worked so well for residential” – B.B.

B.B. you have become a humanitarian, congratulations!

Believing in, and supporting your community is the best thing for you.

I am glad you have shown your inner decency.

My understanding is that the small businesses help the landlords pay the building taxes. Why would that be a renters obligation? Also the continuous scaffolding blocks light and disability from the storefronts. A business with 50 employees is considered a big business. Another burden for small businesses. Restaurants can’t stay in business and pay $15 minimum wage to servers and stay affordable. I say this as someone who has worked as a server. NY does nothing to encourage small businesses.

It is nearly common boilerplate practice that *all* commercial tenants pay owner’s property taxes in full or part.

Renters of commercial space usually also are required to pay any fines or surcharges against said space. When DSNY hands out tickets for litter on street in front of retail space it is the store or whatever that will pay (one way or another), not the LL.

What will we readers of West Side Rag do if small businesses stop closing?

For one, the quality of our lives in the neighborhood will improve. That’s a good start and worthwhile goal.

If it’s just rents and Amazon, why are storefronts in Tribeca all filled and doing great? There’s a problem with our neighborhood. Also, why are all these nail salon/foot rub places opening up? How do they afford the rent?

The women on the UWS support these salons. Plus they are opened by syndicates. They are not independent businesses.

West Side Rag needs ‘like’ button. Will greatly simplify the process of agreeing with someone.

Like

The solution is simple – apply a tax on large businesses and use the proceeds to subsidize small businesses. We should also increase taxes on the wealthy and provide more assistance to the less fortunate, but that is another story . . .

Just who do you think is paying a bulk of NYC/NYS taxes already? Hint it ain’t the middle or lower classes.

https://nypost.com/2014/04/15/citys-one-percent-pay-larger-income-tax-share-than-rest-of-us/

Just as with federal low income households pay nil to no income taxes. Middle classes depending upon where that scale they fall and other variables (such as being a homeowner versus renter, etc…) far slightly better. But never the less it is the top one to two percent who pay a majority of income taxes.

In fact share of revenue from income taxes in NYS has been dropping for years. Largely because low to moderate do not pay, and middle class is fleeing to places with either lower tax burdens, and or where they get more for their money. Things like better public schools and other amenities.

There is a need for the City to raise taxes on any Landlord who keeps a store vacant over an extended period of time. Greed is keeping many of these stores vacant and there has to be a punishment for not renting to small businesses and to get shops back in our neighborhoods. It is a quality of life issue and we need more elected officials like Mark Levine who understand and are acting on this issue.

One of the bedrock principles of residential rent regulation is that the apartment be the primary residence of the lessee. If you supports this type of regulation, then you should also insist that commercial rent regulation include a requirement that the lessee not be a non-NYS, or even non-NYC, resident who receives local rent protection but takes their earnings elsewhere. Taking it another step further, the degree of rent protection should also be tied to the residencies of the employees of any business that receives rent benefits. Why should commercial rent regulation exist if not to support and add stability to locally & independently-owned businesses? That’s the message I get from everyone screaming about the proliferation of chain stores.

Again, in case some of you didn’t know; many of those “greedy” commercial landlords are shareholders in co-op buildings.

Federal government changed the “80/20” rules late in 2007, and it began affecting commercial leases in co-op buildings in 2008 and onwards. In short many commercial tenants in ground floor retail who once had sweetheart rates got quite shock at renewal.

https://www.nytimes.com/2008/01/20/realestate/20cov.html

Prior to this change many co-ops were happy to get enough rent from commercial retail to cover property taxes. Now with changes in place that said they could make some money, most promptly did just that.

It makes perfect sense for a co-op since more money they can get from retail/commercial space beefs up reserves, and or goes for improvements which won’t cost shareholders a penny. This and high commercial rents allow for lower maintenance costs to shareholders as well.

Union 32BJ has just come out against “commercial rent control” as well.

Momentum against seems to be growing, and not from what most would consider here to be the usual suspects.

https://www.habitatmag.com/Publication-Content/Building-Operations/2018/2018-October/Commercial-Rent-Control

B.B.

You know that vested interests vote their interest.

But…

This is a neighborhood, so I will comment from a person’s perspective.

Most people live in the City because they enjoy the activity on the streets: the sights, sounds and especially the interactions. Small businesses are a part of that. The shopkeepers themselves, the interactions in their shops, and especially the fact that they get us all out there onto the mingling streets.

I understand that there are Real Estate Interests, and Co-op interests and even Union interests, but do you really believe any of those interest groups are primarily concerned with wellbeing of the millions of people being affected?