Is everyone waiting for 2026? Or will some (perhaps the savvy) choose to wade in ahead of it all. With so many factors to weigh, the question is what mood will actually prevail? Will we actually see lower long-term rates?…or not? Are sellers at that saturation point and tired of waiting and just list?…or will they hold on further until 2026? Will more buyers have to throw in the towel, place their faith in lower rates and dump their wasteful rentals? So much is simmering.

If you’ve been on this journey with me, you know my position is that it’s all about the rates, which have been relatively high and kept deal volume contained. The thinking right now is that rates are inevitably going to drop, if for no other reason that Trump will have nominated two people to the Fed’s committee between now and next Spring…including the chairmanship and he is dead set on lowering rates. The question here is, will it actually drop long-term mortgage rates? That is not a forgone conclusion…here’s why:

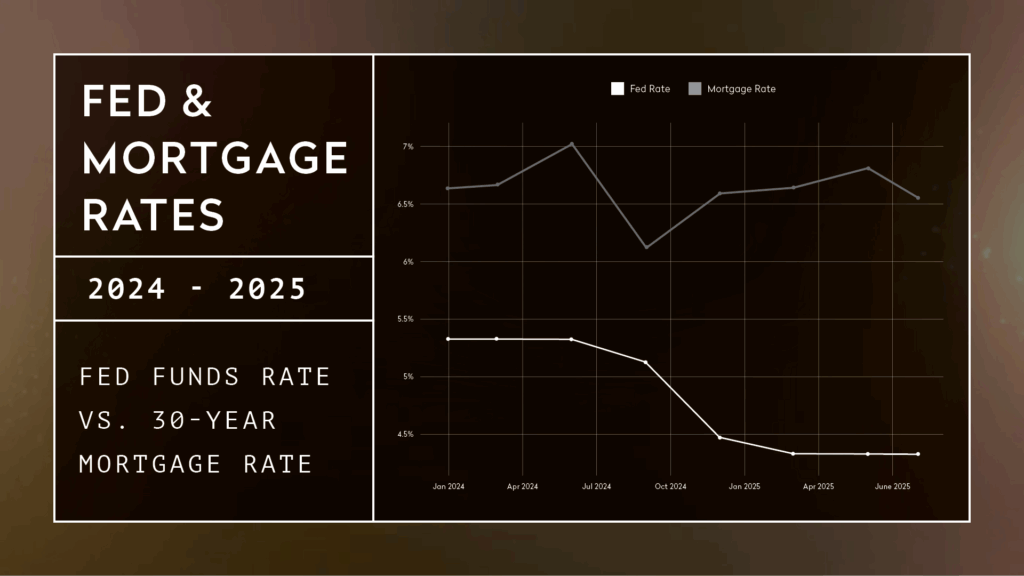

The Fed only controls short-term rates, the financial markets determine the longer term rates. If investors don’t believe that a rate drop by the Fed is justified (in this case because of tariffs and inflation risk), the markets will do their work to compensate for that. This rare occurrence, which if you recall, happened just one year ago (Fall of 2024) when the Fed dropped short rates (again, they do not control long term rates) by ¾ of a percent and the longer term rates actually jumped…in a seemingly reactionary fashion. In the chart below, pay close attention to the divergence of the curves starting in September of 2024.

Fed Funds Rate vs. 30-Year Mortgage Rate (2024-2025, Monthly)

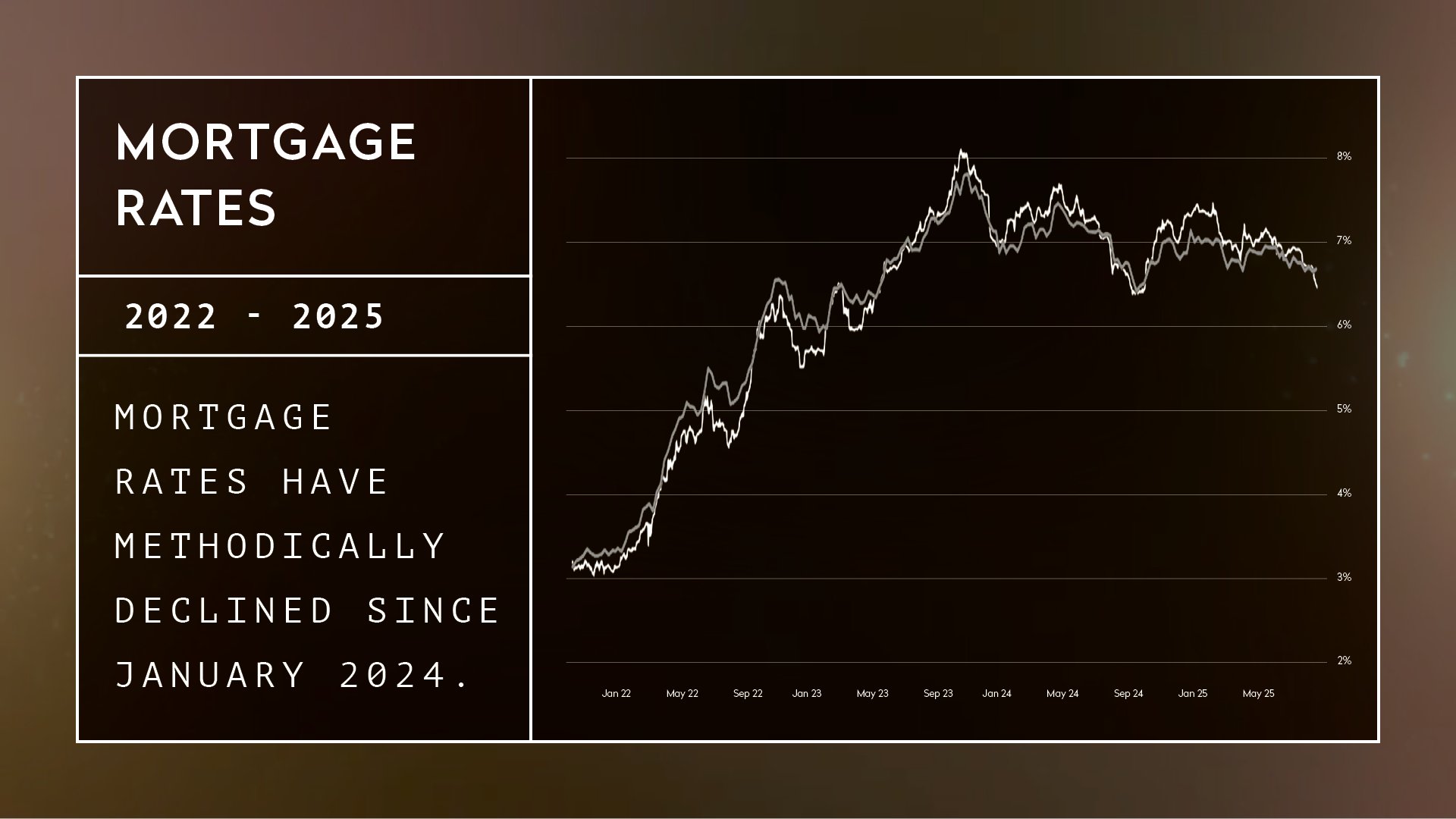

Yes, it was counter-intuitive; but with inflation still “hot” the markets took over, feeling that the cuts were unjustified and, as mentioned, compensated by letting the long term rates rise. Typically, when the economy is under less pressure, without tariff risks and potential inflation, the curves would run more in tandem. The marketplace is like a wave (not controllable); policy is merely a strategy to surf that wave and how best to manage it. Although rates have indeed eased since early 2024 (see chart), the public conflict now regarding the direction rates should take is between the Trump administration and The Fed. One economist called this “monetary stability vs. fiscal convenience.”

In the midst of cooling inflation, mortgage rates edged lower but remained elevated compared to pre-2022 levels. While both sides feel that rates are restrictive, our fiscal policy has no option but to deal with our enormous government deficits, whether we like it or not. Trump wants them lower because the interest on our debt is costly; the Fed simply feels that there’s more to it than just that. This battle will continue, but based on the Fed Funds Rate Probability chart rates are trending downward.

While both sides feel that rates are restrictive, our fiscal policy has no option but to deal with our enormous government deficits, whether we like it or not. Trump wants them lower because the interest on our debt is costly; the Fed simply feels that there’s more to it than just that. This battle will continue, but based on the Fed Funds Rate Probability chart rates are trending downward.

CME FedWatch Probabilities Tool

CME FedWatch Probabilities Tool

IF rates are indeed headed downward, that will unleash substantial demand, which has been corralled for years. When that happens, FOMO ensues…and don’t forget the “Great Wealth Transfer” which most estimates have at $100 Trillion (with a “T”) of wealth transferring by 2048…and it has already begun. Much of this wealth is expected to be geared at purchasing real estate. Once buyers conceptually digest that they’ve got more leverage than sellers hope they would, they will also realize that this could be the last fleeting moment of “real value” before the market accelerates away from them. So, let’s get ahead of it and go shopping!

And Remember, I always say: 1) Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them; and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.