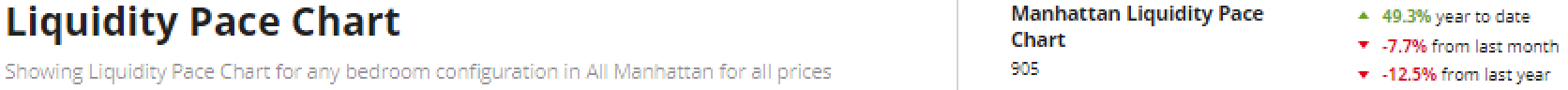

The real story in the marketplace right now…Where ALL the action seems to be happening?…is in the rental market. Tis’ the season…it’s rental season; the time period when most people pick-up and move. As the sale market sits back in the shade, the activity on the rental side is becoming increasingly frenetic. Because of the economics of the moment (meaning everything’s expensive), we all know interest rates have lots of would-be buyers on the sidelines. Deal volume over the past three years has progressively dropped (see the Liquidity Pace chart below, which measures the number of contract signed deals over the past running 30 days).

The real story in the marketplace right now…Where ALL the action seems to be happening?…is in the rental market. Tis’ the season…it’s rental season; the time period when most people pick-up and move. As the sale market sits back in the shade, the activity on the rental side is becoming increasingly frenetic. Because of the economics of the moment (meaning everything’s expensive), we all know interest rates have lots of would-be buyers on the sidelines. Deal volume over the past three years has progressively dropped (see the Liquidity Pace chart below, which measures the number of contract signed deals over the past running 30 days).

At this time in May of 2021 when the sale market was in a frenzy and interest rates were still super low (in the 3% range) deal volume was at a rate of 1,816 deals over the most recent 30 days. In May of 2022 it had dropped to 1,401, in May of 2023 to 1,034 and this year down to 905. Regardless of the slowdown, deals are still indeed happening. If you consider what I always say, which is that “the greatest barrier to entering the Manhattan marketplace is not the price, but the competition” then one will clearly see the opportunity this slowdown presents, IF one is serious about buying in the coming year or so.

With this malaise draped over the sale market, the focus is on rentals. To paint the picture for you a bit, there are sale properties which have struggled to simply generate showings, which when the owners decided to switch gears and rent instead, the brokers representing them are receiving 20, 30, 40 inquiries in just a matter of hours. Last summer the rental market peaked…all-time highs; naturally it slowed in the Winter months, but is now on the cusp of tremendous acceleration. As mentioned, we’re at the beginnings of the busy season and demand is mounting. I personally believe we’re likely to surpass last year and establish even new highs.

The choice, for most, to rent over buy, is only ONE of the pressure points on the competitiveness in the marketplace. The other is that those, currently in rentals, aren’t moving in any large numbers; at least they haven’t revealed themselves YET. And this is putting overwhelming demand pressure on the units that are actually available now. Meaning, prices are merely a suggestion, with bidding wars happening…for rentals!!

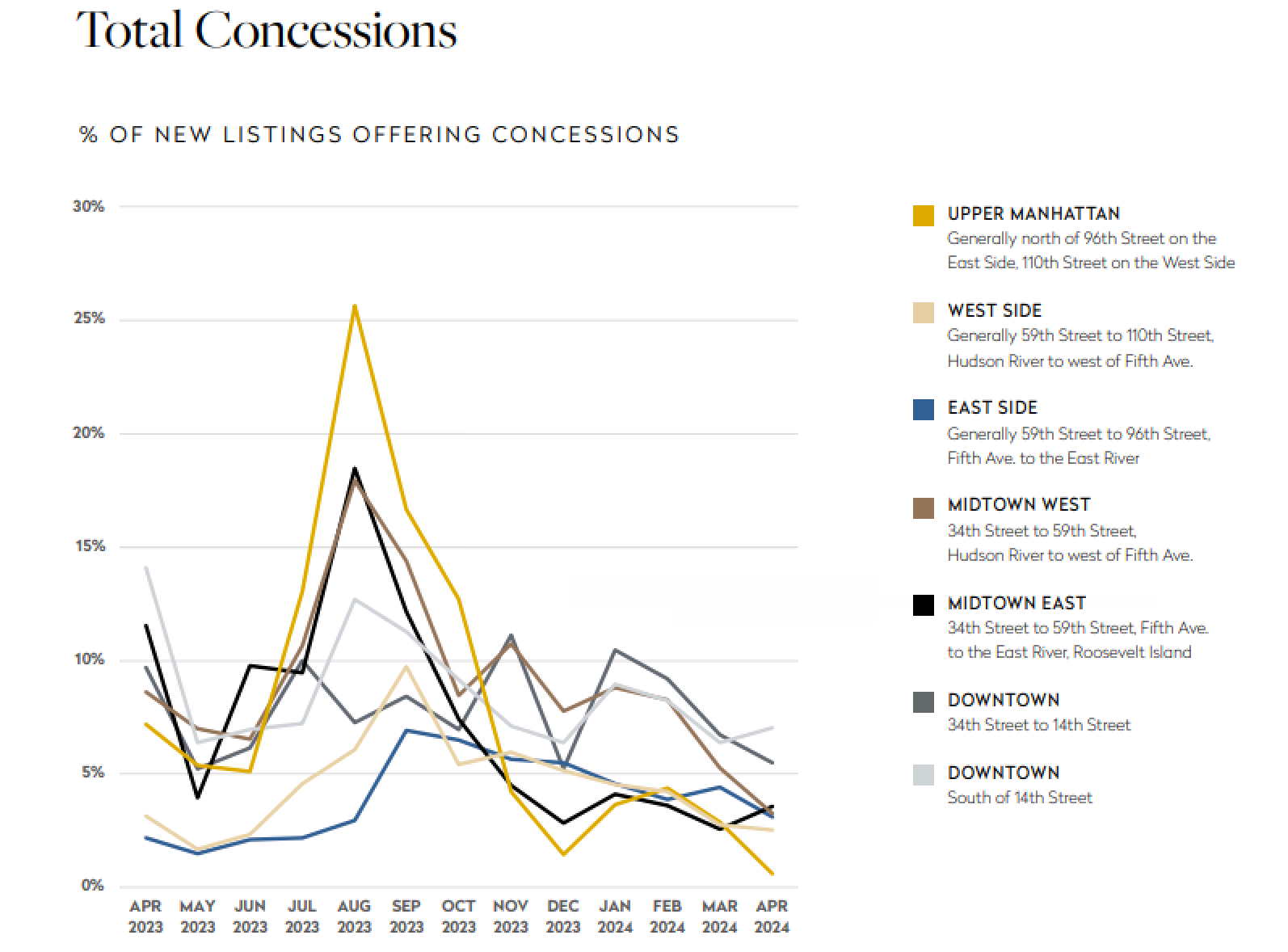

Look at the chart below, as a result concessions continue to disappear.

So you have to consider the moment. Even with all the geopolitical unpredictability, conflict and confusion…and the mixed economic messages from interest rates to inflation to jobs…you name it, we are still in the midst of a fairly robust economy.

So you have to consider the moment. Even with all the geopolitical unpredictability, conflict and confusion…and the mixed economic messages from interest rates to inflation to jobs…you name it, we are still in the midst of a fairly robust economy.

Where do you fit in? What’s your goal? Should you be renting? Or should you actually buy?

The information is foggy, right? So if you’re trying to make this decision it’s important to ask yourself, “What’s your time horizon?” And almost as importantly…“What’s your time horizon for making that decision?

Let me know….I’m always happy to chat…

I always say: 1) Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them; and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.

I always say: 1) Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them; and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.