“Follow the money” is what they say. If you do…it becomes very evident that people truly believe in Manhattan; confidence is strong. In spite of so many negative forces from the financial sector including rising interest rates and inflation to the geo-political threats to the health crisis…market activity has been robust. Interestingly, contract signed activity did taper going into the holiday season and through January, which is indicative of the “typical” cycle and seasonality we would see pre-covid (and anecdotally represents a return to “normal life”). But that should not be confused with a slow market. November saw 55% more deals signed than the historical average of prior Novembers; December saw 44% more deals and January 28% more. That gap seems to be narrowing, but I believe it stems from the constrained numbers of the overall inventory.

I tried to get away from this theme, as it was the same last month, but the story remains the same, the two “I’”: Interest Rates and Inventory. We all know that because of inflation there’s tremendous pressure on the Fed to raise rates and taper their bond purchases and they are committed to doing it, as it has already started. As a result mortgage rates have increased over half a point in just 4 months (see chart below). And they are expected to continue rising into the end of the year. Many economist anticipate the 30 year fixed mortgage will settle in around 3.65-3.8% by then. The prospect of these higher rates has buyers increasingly anxious about what they will be able to afford, especially considering the palpable competition which will exist for relatively few properties.

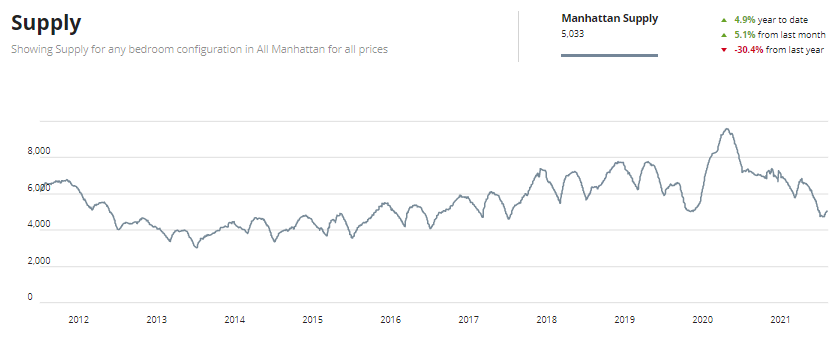

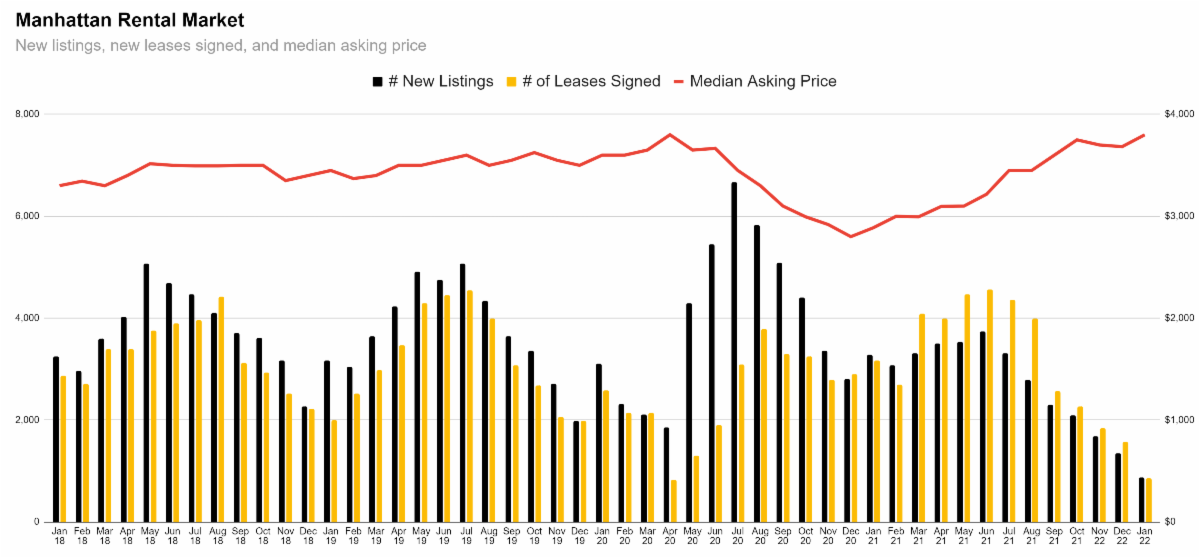

Which leads me to the real story. Where is all the inventory? Although we are beginning to see new properties trickle onto the market, we are all still waiting for a stronger flow. With demand strong, many buyers are frustrated and thirsty and it’s eventually going to result in higher prices. We are certain to see an increase in inventory in the coming months as we hit the peak listing season, but the question remains, “how much inventory will actually materialize?” This will determine how the year plays out. If there’s nothing to buy or sell, prices will escalate at a faster pace than expected.

Your best investment is often in the broker you choose. Find someone with experience, who you feel you can trust. Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them.

* See the analysis below of what even a 1% difference in interest rates does to your purchasing power. The interest rate increases we have already seen, and those to come, present urgency for buyers to act sooner rather than later. Note: this is not just a buyer’s issue; sellers must realize that it affects what buyers can offer them as well.