SPONSORED

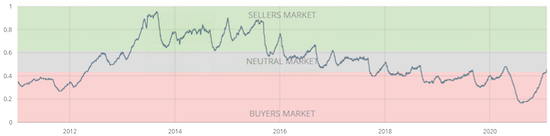

Is it last call? For those seeking to find “the bottom”, likely so. In the end the bottom of the market may well be defined as October/November 2020, when the initial Covid deals started to actually close, reflecting the most extreme dislocation brought on by the pandemic. Post-election markets have typically surged. This time around it seems consistent, especially with the continued existence of innumerable buyer-favorable metrics. That said, several of these are about to change, meaning the “buyer’s market” leverage is shifting away.

Buyers are beginning to feel a few gusts from a headwind. Sadly for many buyers they will not realize how good they have it until it all slips away from them. They have been able to pick up properties for nearly 10-15% off of their peak (on average) and in some cases between 20-30%. Note, this is just taking into account price.

Consider that interest rates had dropped nearly 2 entire points in the past couple years. As rates rise purchasing power erodes. We have experienced some of the lowest interest rates we have ever seen, but they have already begun to come off those lows. As the economy recovers the Federal Reserve will stop buying mortgage backed bonds, resulting in higher rates. So the high-2’s we have seen of late are likely to give way to mid-3’s. (See the chart below in the “Mortgage & Interest Rates” section to see what just 1% point does to your purchasing power).

Then comes the unquantifiable: competition and sentiment. Competition, or lack thereof, provided the opportunity to take one’s time to shop around, make low offers and have those, previously ignored, low offers actually get a response. Sentiment has been so negative that sellers have had to be very negotiable to secure buyers (a rare occasion in Manhattan). But with the vaccines arrival comes confidence and a sincere path to normalcy. This will bring more buyers back in to the fold and as a consequence strengthen sellers spines.

At approximately 7,500, inventory is hovering in what would be the “high” range over the past several years; however, the pace of new supply does seem to be slowing. January’s new supply was in the 1,200s, which seems to be more in line with competitive years between 2012 and 2017. Further, deal volume is outpacing new supply, meaning the market is indeed strengthening. Deals are up substantially year-over-year; January 2021 saw 25% more contracts signed than 2020 and 40% more than 2019.

A few yet-to-be-determined factors: 1) Will the new Democratic majority roll-back the cap on SALT tax deductions? If so, that could be a positive bump in buyer perception and their desire to buy. 2) Will the suppressed rental market put downward pressure on sale prices, as buyers look to rentals as a better option? If they do, they will need to reconcile that decision with the once-in-a-generation opportunity they have now to buy.

So timing, as always, is everything. Increased market activity will present a healthy market for both sides to trade. Assemble a good team, which includes an attorney and a mortgage professional. And know that I am here to help you, or your family and friends, craft that team and plan for success.

Read the rest of this entry at this link.

Roberto Cabrera

Roberto Cabrera

Licensed Real Estate Broker

Brown Harris Stevens

212.906.0554

Your City, Your Broker…

#YourCityYourBroker #NewYork #Manhattan