As I’ve mentioned for several months, the current relationship between interest rates and deal volume is acute…and with it follows sentiment. At every instance over the past 24 months when interest rates have momentarily eased, which have not been often, deal volume has accelerated. Most recently we experienced this in August, a notoriously slow time of year, which this year showed a bump, primarily due to the slight rate drop in mortgages. This year, customary market themes shifted; the busy Spring was actually “meh”, while Summer was uncharacteristically busy, up 4% year-on-year.

As I’ve mentioned for several months, the current relationship between interest rates and deal volume is acute…and with it follows sentiment. At every instance over the past 24 months when interest rates have momentarily eased, which have not been often, deal volume has accelerated. Most recently we experienced this in August, a notoriously slow time of year, which this year showed a bump, primarily due to the slight rate drop in mortgages. This year, customary market themes shifted; the busy Spring was actually “meh”, while Summer was uncharacteristically busy, up 4% year-on-year.

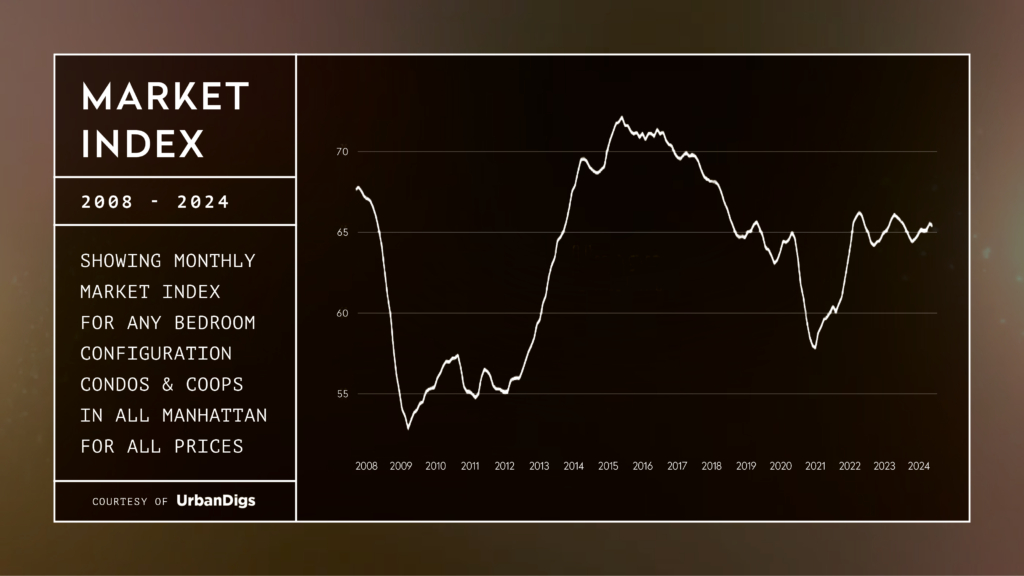

Publicly there are many questions regarding price levels. Are we up? Are we down? and Where’s it going? Well, we have experienced quite a bit of craziness since the highs of 2016/17. We had overbuilt and overpriced; then we got hit with innumerable negative policy initiatives (ranging from the limitation on the SALT deductions, to more aggressive mansion and transfer taxes and an overwhelmingly restrictive slate of rental laws), the pandemic AND massive inflation which led to a massive interest rate spike that started in the Spring of 2022. With all of that…we are only down, on average, probably 10% from those highs [see chart above]. I say “average”, as the market is very segmented and there are certain property types that are outperforming others and vice versa. That said, only 10%?…and during a time period over the last 24 months where we have been experiencing below average deal volume [visible in the chart below]. What this tells me is that we have literally established a floor on how low prices can go. Even with all these obstacles, our market has remained solid…not great, as we never had a crazy bump in prices after covid like other parts of the country; but not bad, as we have not seen prices plummet. This speaks loudly for the demand here in Manhattan. Both buyers and sellers are standing on the starting line just waiting to transact. But what are they really waiting for? It’s the rates. The moment we see a material drop (which has already begun – scroll to the interest rate charts below), the flood gates will open.

At the moment, the uncertainty of so many things (notoriously the presidential election, but also the volatile stock market, geopolitical tension in Israel, Ukraine, Taiwan…you name it) will moderate the flood. However, once the new year passes and we lead into Spring, rates have dropped, people start getting bonuses and it has become evident that increasing numbers of people are (or have already) jumped in…then the marketplace will become extremely active. This will likely favor sellers over buyers, as long as they have an alternative place to go, because demand will be substantial. Once again, it will become musical chairs for apartments. So as the saying goes about early adopters, “the early bird gets the worm.” If anyone is buying, they will be far better served getting ahead of the herd mentality (FOMO) which is sure to set in. The greatest barrier to entry into the Manhattan marketplace is not the price, it’s the competition.

If you’re a seller, you should realize that demand (buyers) can react faster to market conditions than you can. They can just jump in, whereas you need time to prepare your property for market; so start now. You want to be ultimately ready to pull the trigger when necessary. The macro-market conditions described above are all indicators of fading buyer leverage, which most don’t realize. As a seller, you should recognize this irony; because regardless, buyers are feeling better (sentiment-wise), as they are solely focused on rates, which have already started their decent. So the market is stacking up to offer each side of the table something different and fruitful; you must simply have the right perspective. There is likely to be A LOT of movement come late Winter and early Spring.

I always say: 1) Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them; and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.