Dear Subscriber,

Dear Subscriber,

Our focus for this March edition includes:

- The status and outlook for inflation on our real estate market

- The status and outlook for mortgage rates on our real estate market

- The impact of the recent bank crisis on our real estate market

Inflation

Inflation, the bugaboo that’s been menacing our markets, has ratcheted down for another month from 6.4 to 6.0%. After registering a high of 9.1% last July, this drop is a positive sign but still far above the Fed’s target of 2.0%, and still capable of inhibiting market growth.

Mortgage Rates

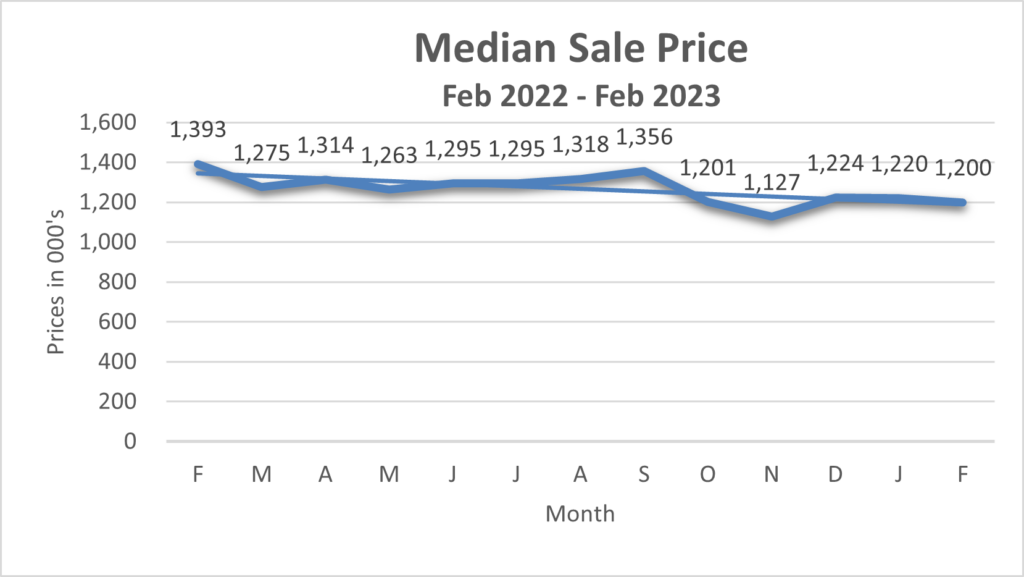

The Fed’s major tool to combat inflation is raising interest rates which, by default, includes mortgage rates. Prospective home buyers are being handicapped by decreased purchasing power, resulting in weakened demand for housing, and subsequent declining listing inventories and prices.

“30-Year Fixed Mortgage Rates”have dropped off a bit from a high In July of 7% to 6.5% currently a modest improvement considerating that these rates had increased about 40% from a year ago, and are unlikely to encourage any significant demand for mortgages.

The Banking Crisis

Following on the Trump administration’s ill-advised deregulation of the banking industry, banks were able to take on riskier investments, and now the inevitable consequence has occurred: Silicon Valley Bank was unable to allow depositors to withdraw funds on demand, prompting a panic that spread to other banks who had followed the same risky deregulated practices a la SVB.

Swift emergency measures were devised by the Fed and leading national banks to avoid a meltdown of the entire banking industry that otherwise would have subsequently ensued.

Considerable uncertainty about the future of the economy’s markets existed prior to Silicon Valley Bank’s collapse, as reflected in the weakness in prices and inventories over the past year or so. But this new banking crisis has compounded the pre-existing degree of uncertainty by orders of magnitude. At this stage it’s problematic to forecast the track of real estate markets with precision, but it’s likely that credit will become more expensive and less available.

What’s Next?

What’s Next?

Have you been considering buying or selling an apartment in the coming year? No doubt the heightened level of uncertainty in our real estate market has caused you to pause and reflect how to adjust your real estate plans accordingly.

As you might expect, good deals can be found in down markets if one is vigilant and adequately prepared. If you’re interested in learning more about this intriguing possibility, just click on the link below to explore how to identify and transact exceptional down market deals.

Thanks for your interest and stay tuned.

Data courtesy of Urban Digs