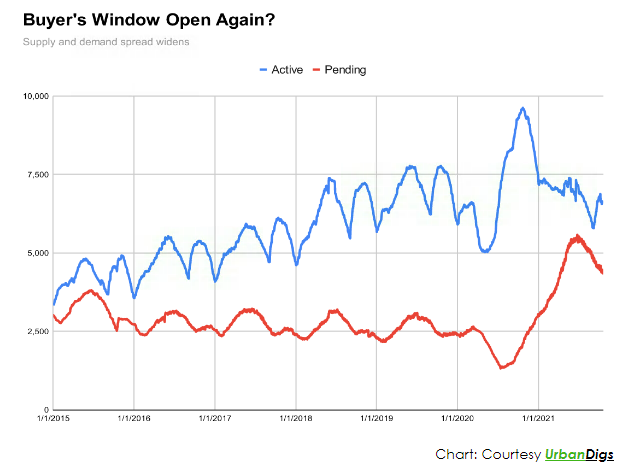

It’s a seesaw and both parties, buyer and seller, are airborne…suspended in equilibrium, for now…but as always, the momentum will eventually lean in favor of the heavy weight, the seller. Buyers have always had to be welterweights, faster, lighter on their feet….nimble. As mentioned though, right now, the market is wonderfully balanced for both parties to thrive. With approximately 6,600 listings on the market (down from last year’s highs of 9,500+, but above lean years like 2013, 2014 & 2015 when inventory occasionally dropped below 4,000), buyers still have a moderate level of choice. It’s no longer like trying to acquire concert tickets. You can visit a property, see it again and even negotiate; this is a healthy place to be for buyers. That said, if you wait too long, this window will pass.

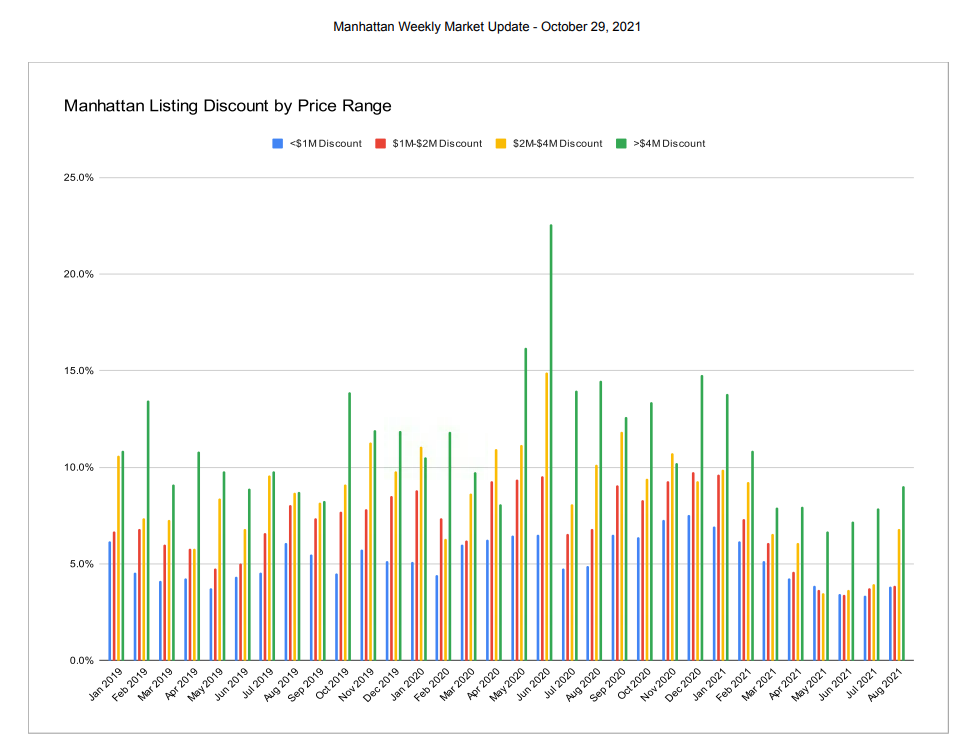

While the market pace has moderated from the frenzy of Spring/Summer, some buyers have been spooked by the headlines focusing on the overwhelming deal volume. The stories not being told, which they should concentrate on, are: 1) the fact that, while the “Covid discount” has virtually disappeared, there has been no significant price appreciation that has occurred…yet; and 2) as a buyer, the timing of “now” could be your greatest asset.

Right “now” the marketplace is seemingly in equilibrium; generally speaking: Pricing levels have recuperated to pre-pandemic (2019) levels, but no further. Real sellers are not overpricing and are negotiable. You actually have properties to choose from. Interest rates are still low. And we are seeing a return to seasonality, in that this is likely the calm before the storm.

Buyers always tend to fare well at the end of the year. As many buyers check-out for the holidays, there is a reduction in demand/competition. Likewise, some industries, like Wall Street, tend to put the brakes on their searches while they wait to see what bonus season will bring in January/February. Subsequently…leading into the Spring, a lot of money floods the market, competition for good property becomes palpable, deal volume spikes and buyer frustration follows. This particular year is anticipated to be strong for bonuses and again interest rates remain low for now.

Beyond the immediate time frame, the coming years bode strongly for moderate, but methodical price appreciation. Although the city feels like it is pumping, we are only about 70% back, by my estimation. We still have commercial and retail that are not quite up-to-speed. We have foreigners who are just now beginning to trickle in. Also the lack of new construction during covid could further tighten inventory in the coming year or so. As the pace of this recovery accelerates, so will the demand for property. Let’s not forget that the new Mayor coupled with a diversified economy, including a growing tech sector, has many seeing greener pastures.

Sellers are in a great position as demand is stronger than past years at this time. If priced right, they can get in and get out. Overpricing is the single biggest mistake they can make, as this is an extremely price sensitive market. Apartments are being absorbed at a healthy pace; so sellers who respect the process will succeed. We have seen over 300 contracts signed in each of the past two weeks. The other mistake sellers can make is not preparing your property for sale. If your home does not show well, you are cheating yourself and will be selling at a discount. There are too many glossy new apartments out there with all sorts of bells and whistles and you must compete for the attention given them. Apartments that need work are truly suffering the most, because renovating has become an increasingly onerous, time consuming and expensive proposition.

7.2% fewer rental listings were listed in Manhattan in September of 2021 vs. September of 2020, and 79% more were listed in September 2021 than in September 2019.

Studios:

September 2021: 974 studios were listed, at average price of $2,812 (6.3% increase since August 2021)

September 2020: 1723 studios were listed, at average price of $2,279 (2.6% drop from August 2020)

September 2019: 916 studios were listed, at average price of $2,771 (1% drop from August 2020)

1BRs:

September 2021: 2594 1BRs were listed, at average price of $3,465 (0.6% increase since August 2021)

September 2020: 3233 1BRs were listed, at average price of $3,107 (4.2% drop from August 2020)

September 2019: 1732 1BRs were listed, at average price of $3,652 (0.9% drop from August 2019)

2BRs:

September 2021: 1419 2BRs were listed, at average price of $4,690 (5% increase since August 2021)

September 2020: 1769 2BRs were listed, at average price of $4,368 (1.5% drop from August 2020)

September 2019: 944 2BRs were listed, at average price of $5,142 (2.5% increase from August 2019)

3BRs:

September 2021: 478 3BRs were listed, at average price of $5,740 (10% increase from August 2021)

September 2020: 561 3BRs were listed, at average price of $5,670 (4.2% increase from August 2020)

September 2019: 305 3BRs were listed, at average price of $6,688 (1.9% increase from August 2019)

Studios:

The average asking price was 23.4% above the average asking price in September 2020 and 1.5% above the average asking price in September 2019.

1BRs:

The average asking price was 11.5% above the average asking price in September 2020 and 5.1% below the average asking price in September 2019.

2BRs:

The average asking price was 7.4% above the average asking price in September 2020 and 8.8% below the average asking price in September 2019.

3BRs:

The average asking price was 1.2% above the average asking price in September 2020 and 14.2% below the average asking price in September 2019.

Roberto Cabrera

Roberto Cabrera

Licensed Real Estate Broker

Brown Harris Stevens

212.906.0554

Your City, Your Broker…

#YourCityYourBroker #NewYork #Manhattan