Is this the year?

Is this actually the year you Buy? Sell? Upgrade? If so, let’s catch you up on what has happened and where we are.

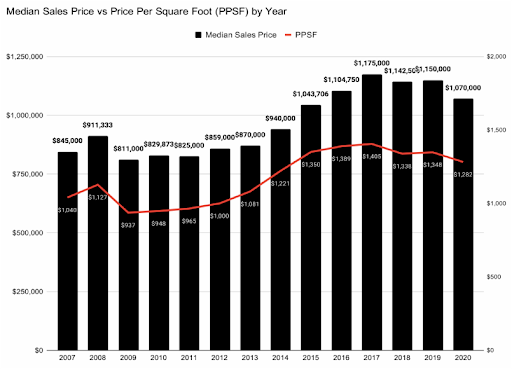

The broad stroke is that Manhattan has roared back faster and more substantially than we thought possible back in May and June of last year. There is a natural tendency to compare this time to the financial crisis; however, the underlying fundamentals were quite different then. Prices have not dipped as severely as we saw back then (see chart courtesy UrbanDigs). Likewise, interest rates after the financial crisis were hovering around 5%; whereas now they are in the mid to high 2’s. Liquidity was scarce and financing was extremely difficult to obtain. Today, helped by a surging stock market*, there are trillions of dollars sitting on the sidelines awaiting that perfect moment to engage in other assets like real estate. *Some consider the stock market artificially over-heated and unsubstantiated, which could be the signal of an impending sell-off to reap profits, creating even more liquidity to inject into property.

With the vaccine, comes confidence in our ability as a society to return to a more normal way of life, not to mention a more gentile political environment. That positive sentiment is already in the ether of Manhattan’s marketplace, as growing numbers of buyers have recognized the value and unique opportunity…one in which Manhattan is considered affordable…a good deal. Ask yourself, when in your lifetime have you heard that? It is a rare time which should demand that we all analyze how we can reposition ourselves for success in the coming 5-10 year cycle. I too often hear the

“could’ve, should’ve would’ve” stories when clients did not act after the financial crisis. Similarly this is a moment of dislocation, but with far better fundamentals from which to capitalize.

Timing is everything. The market is on the cusp of robust activity. Thus far, the strong demand we have seen has been primarily fueled by those moving within Manhattan. However, many who fled the city will begin to return, not all…but many. They see ample choices and negotiability here, which are non-existent in the suburbs right now. Consider that many who left signed one-year leases and will be looking to come back; that activity will begin soon. Others, who now see Manhattan as potentially affordable, will come to the city for the first time, further filling in the gaps. Then there are the foreigner buyers who will methodically begin to filter in, seeing the weakening dollar as an opportunity. Also, with the ink still wet on Brexit, some will also consider Manhattan a safer bet than London.

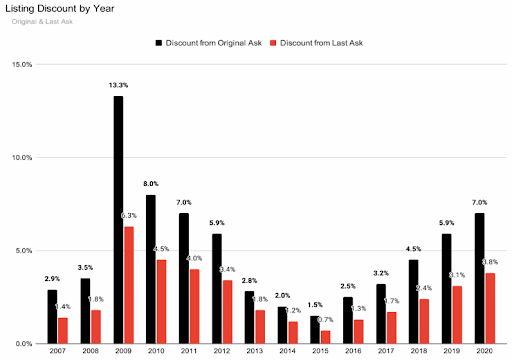

A few other factors to consider: As a result of the shutdown, the bulk of the year’s deal volume came in the 4th quarter. December contracts were up an unexpected 30% from the prior December. Interestingly, busy Decembers have often translated into a busy coming year. Inventory, which drastically contracted at the year-end, is expected to sky-rocket in the first several months of the year. Although discounts vary in degree depending on which market sector you are in, they are currently averaging 10% off the original ask, some more…some less. Some economist feel inflation could be a growing concern in the coming years. Real estate has always been considered a great hedge to fend that off. Assuming this comes about, real estate will become an extremely valued asset to have in one’s portfolio. Seizing a good value today could multiply that benefit.

So the timing for most, even sellers, is beginning to look up; an increase in market activity will reflect a healthy market to trade on both sides.

“It’s all in the negotiation. It’s all in the representation today…everything

is very emotional and sensitive with buyers. Anything can kill a deal in a

second. Use a smart broker who knows how to negotiate for you.”

– Shlomi Reuveni, President & CEO of Reuveni Real Estate

Assemble a good team, which includes an attorney and a mortgage professional. And know that I am here to help you craft that team and plan for success.

Roberto Cabrera

Roberto Cabrera

Licensed Real Estate Broker

Brown Harris Stevens

212.906.0554

Your City, Your Broker…

#YourCityYourBroker #NewYork #Manhattan