As the shock and hysteria has moderated, more people are acclimating and solidifying their long-term belief and commitment to our great city. Contrary to common opinion, market activity has been resuscitated, particularly below $1.5-2M levels where activity is robust. However, even pockets of the luxury market are seeing deals, as people are capitalizing on the favorable market conditions. One of the primary drivers are interest rates.

Two years ago it would have cost you $61,692/year to borrow $1M. Today you would save nearly $12K per year, as it would only cost $49,776. Interest rates are historically low and according to the Fed’s recent announcement will likely remain low until 2022. In the Fall of 2018 the 30-year jumbo fixed rate mortgage was approximately 4.625%; it’s currently hovering around 2.875% (see mortgage rates below). Motivated buyers are being pre-approved to identify what they can afford. If you need lender suggestions, please let me know.

Buyers also have many more options to choose from. When the crisis started, sellers pulled their listing from the marketplace, dropping inventory to 5,031 by mid-May, down from what would typically be around 7,500 (courtesy of UrbanDigs). However, it has now swelled to 8,655, 24% above last year at this time, but, for perspective, shy of the approximate 10,000 after the financial crisis (courtesy Miller Samuel Inc.).

Pricing has become favorable and negotiability is substantial. Deals that were consummated post-Covid are beginning to close; consequently, we are learning the effects of the crisis on our marketplace. Between the deals which have actually closed and industry consensus, negotiability is around 6-7% off asking prices. Buyers who were hoping for larger spreads forget the marketplace had already experienced 4-5 years of consistent decline. Note: those declines were primarily driven by unfavorable real estate policy including, but not limited to: the reduction in the SALT (state and local tax deductions), increases in the mansion and transfer taxes, rent regulations on multi-family properties and limits on LLC purchases.

Negotiability is tighter at lower price points where deal volume is stronger and widens as you go up the price scale. The luxury and super-luxury sectors are off closer to 10% and even more. While some sellers refuse to accept this reality, they will have to acquiesce, as appraisals will begin to reflect these new levels and place downward pressure on prices.

Historically it is these moments of dislocation, where people have made the best investments. Those, with the wherewithal, who are looking to upgrade are being served a silver platter. My buyers are pre-approved, with attorneys in place, making offers and identifying deals that work for them. If you want or need to be equally prepared, let me know, as I am here to get you to that place. Everyone’s situation is unique and should be evaluated independently. Likewise, each neighborhood is experiencing its own unique transition, so must also be studied independently.

These are all the major considerations both buyers and sellers are sorting through. If not for a Presidential election year, activity in the second half of 2020 would be even greater. Once the certainty of knowing who our leader will be, the market will begin to chug along at a faster pace. Note: it is my opinion that by the 21-22 school year (one year from now), we will be much closer to a normal way of life. That said, I believe that next Spring/Summer will become very busy with people scrambling to get situated prior to the Fall semester. Consider whether you want to get caught up in that potential frenzy.

See you around campus….

Click the button above to see the latest edition of our post-lockdown deals report, as of 9/15/20. The purpose of the report is to give you verified pricing data on deals negotiated after the NYS lockdown began on March 22nd. This is not meant to be a count of deals signed since the lockdown, as many of those haven’t closed yet.

To be included, a sale must meet all the following criteria:

1) Listed through the RLS, by all firms.

2) Have a contract signed after March 22, 2020

3) Closed and recorded on ACRIS

The spreadsheet, accessible through the above link, is a running total we add to each week. Keep in mind some sales may drop off if we find out the contract signed date was incorrect.

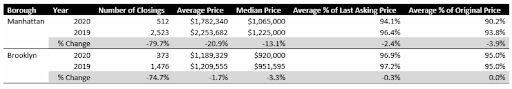

Below is a comparison of the data in this report to the same period last year:

Roberto Cabrera

Roberto Cabrera

Licensed Real Estate Broker

Brown Harris Stevens

212.906.0554

Your City, Your Broker…

#YourCityYourBroker #NewYork #Manhattan