Where do we go from here? From the perspective of buying residential real estate in Manhattan, this is when post-election sentiment customarily realizes that it was all much ado about nothing. It was always a time that followed notorious pre-election uncertainty where deal volume would materially decline; however, this time was different. From multiple perspectives, as you will see from all three of the UrbanDigs charts below, the pre-election market this time around revealed a different attitude. The market was active…and interestingly ahead of this particular election, which seemingly had higher stakes than any other. Each metric was up substantially from last year during this same time period.

Showing monthly Contract Activity for any bedroom configuration in All Manhattan for all prices: “Monthly Contract Activity has risen 45.4% from the past month and has risen 25.8% from this time last year.”

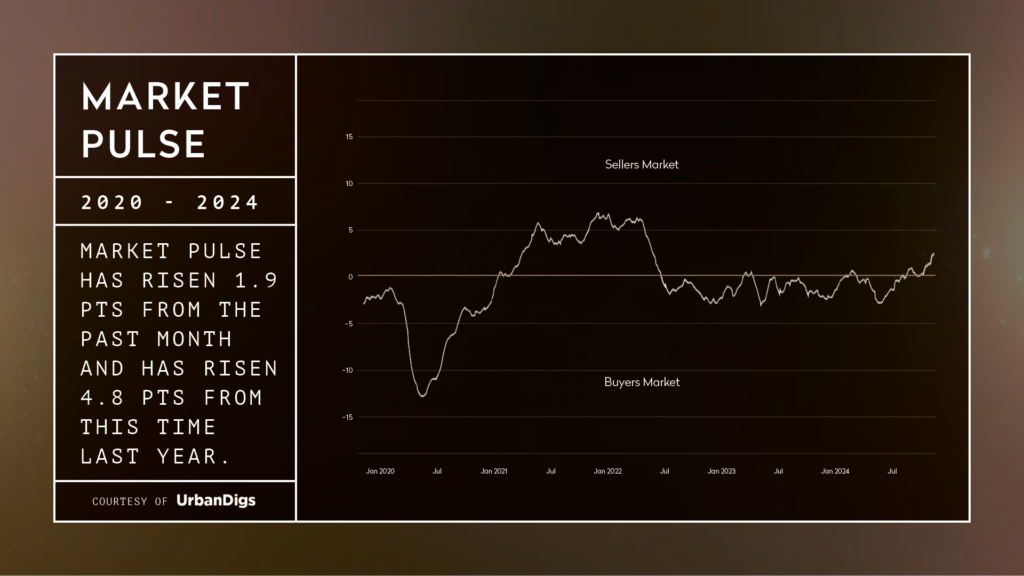

Showing monthly Market Pulse for any bedroom configuration in All Manhattan for all prices: “Market Pulse has risen 1.9 pts from the past month and has risen 4.8 pts from this time last year.”

Showing monthly Liquidity Pace Chart for any bedroom configuration in All Manhattan for all prices: “Liquidity Pace Chart has risen 17.5% from the past month and has risen 20.9% from this time last year.”

So why was it different? Why would people feel more confident than a year ago to buy and/or sell now, than last year? It has to be a combination of interest rates, time and sentiment. The “interest rates” part reflects the pure economics of the matter; it is more affordable to buy now than a year ago when rates were nearly an entire percentage point higher. With “time” we experience life circumstances which require us to move, whether it be a job change, a new child, a divorce…the list goes on, causing more people to enter the marketplace out of need, rather than choice; these are events which become unsustainable circumstances. And finally, “sentiment” whereby people are just feeling better about their own circumstances or the economy or the world and/or they just get used to it and accept the new reality. These three forces together simply outweighed the uncertainty of the election. It is highly unlikely that we will see 2.5-3% interest rates again, at least for the next generation. We are in the high 6% range right now, whereas the national average for 30 year mortgages over the past 50 years is actually in the high 7’s. It’s about perspective. The past decade of uncharacteristically low rates was actually an anomaly and gave us a sugar high from which we crashed. That withdrawal is slowly wearing off.

The increased activity we’ve recently experienced, even at a time of moderate to low inventory, has actually created a marketplace which, as I spoke about last month, is in equilibrium between buyers and sellers. There is substantial demand out there for sellers to get a deal done, as long as they price right; the days of aspirational pricing have gone away with the low interest rates. Price right; get in and get out. Buyers have the opportunity to negotiate without too many people to compete with.

So back to Quo vadis…where do we go from here? Well, no one can know for sure, but the pace and trajectory of this marketplace is leaning us in a direction of substantially increased activity and more sellers will feel comfortable selling. The improving economics of a purchase, due to the likelihood of continued easing rates, will bring many buyers into the fold. What will likely materialize is a very busy market where the supply and demand forces will yield palpable competition and hence…rising prices. We will watch this together. Stay tuned.

I always say: 1) Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them; and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.